Politics

8 Ways You Could Be Growing Your Revenue

Published

12 months agoon

By

Drew Simpson

You didn’t start your company to lose money. However, you don’t want just to break even, either. Ideally, you want the healthiest possible profit margin. And that one way to do that is by growing your revenue streams.

As a refresher, revenue is the cash coming into the business. Typically indicated at the top of your organization’s income statement, revenue is highly variable. Some years it might be up; some years, it might be down. Ideally, you want your revenue to be as strong as possible to offset variable expenses.

Of course, boosting your revenue usually doesn’t happen without a little tinkering. Sure, you might get lucky and enjoy an unexpected spike now and then. But you can’t bank on luck. Instead, you need to put some measures in place to nudge your revenue higher and higher.

1. Reignite former customers.

Chances are good that you have information on your past customers. These were people you spent money to acquire and who spent money on your brand. Rather than accepting that they’re gone for good, why not take steps to reignite their interest?

For instance, think about all the customers who have come back, filled a digital shopping cart, and left. According to Retention.com, seven out of 10 buyers fall into this category. Your objective should be to use the data you already have about them to encourage them to reconsider. You might send texts, emails, or even DMs as reminders. Or, you could try a retargeting campaign.

Although you won’t recapture everyone who leaves, you’ll bring some back into the fold. As a result, your revenue will be stronger than it would have been. Plus, you’ll have the chance to renew your relationship with these “boomerang” buyers.

2. Increase your line of products or services.

Many companies striving for a revenue bump invest in the expansion of their products or services. The trick to making this work is to be sure that the new offerings are relevant. For example, an e-store selling winter recreational merchandise to adult consumers wouldn’t want to add wedding gowns to its lineup. The disconnect would be too vast.

On the other hand, that same company might want to consider adding pet outdoor winter gear and supplies. Many people take their dogs (and some cats) with them on hikes, trails, and other excursions. Consequently, offering customers the chance to keep their four-legged companions comfortable could make sense.

Be certain to conduct research, and don’t just follow your gut instincts if you take this revenue-upping route. You’ll be spending money upfront, after all, and you want to lower your risk as much as possible. The easiest way to do that is to do your homework and expand deliberately.

3. Reduce sales friction points.

A typical sales funnel is inverted for a reason. As leads move deeper down the funnel, some start to trickle out. This is natural, normal, and expected. Nevertheless, it’s not giving your revenue much of a jumpstart.

Sit down with your team and walk through all the customer journeys that make up your sales funnel. Cross-reference those journeys with data. Where do you see areas of major lead drop-off? Those are gaps — and if you fix them, you should see a corresponding spike in bottom-of-funnel conversions.

If you’re not sure how to correct a friction point, consider working with a marketing expert. It’s worth spending money to do things the right way the first time. If you’d rather do everything in-house, make small changes that can be tested in real-time. Don’t attempt to remedy all your gaps at once, because you might not know which strategy is serving up results.

4. Work harder on cross-sells and upsells.

Consumers who have had a good experience statistically spend 140% more in purchases than their dissatisfied counterparts. They won’t automatically know what else to consider buying from your online store or catalog, though. You have to help them by introducing them to items through cross-selling and upselling techniques.

A cross-sell is the sale of something compatible with what a customer’s buying. For instance, a consumer who buys a sofa may want a chair, an ottoman, a side table, or a floor lamp. An upsell is the sale of something more expensive than the customer originally selected. Adding extra cheese or sautéed mushrooms to a burger for a fee is an example of an upsell.

The good news is that there’s a lot of software available to help you automate cross-selling and upselling. The software — usually augmented by predictive AI and ML technologies — can “fetch” cross-sell and upsell options. When done well, cross-selling and upselling can significantly impact your revenue rates.

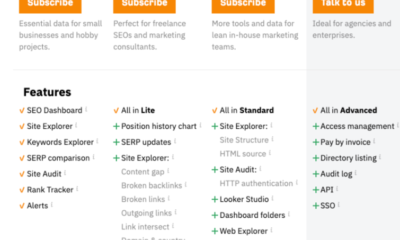

5. Consider a subscription model.

Another way to give your company a bit of dependable income is through subscriptions. Just about any product or service could have a subscription element. That’s why the average person pays $200+ in monthly subscriptions. The key is making sure that your subscription holds enough value for consumers to keep paying.

Part of the reason that subscriptions produce profits is that most consumers set them and forget them. People rarely use their subscriptions the way they think they will. That’s why no one cancels their gym memberships in February even though they’ve stopped going since mid-January!

You can get as creative as you want with your subscription. Anything goes. Who would have assumed that clothing into a subscriber’s delight? Or that people would want to have men’s grooming products delivered? StitchFix and Harry’s Razors, that’s who. Therefore, be open to trying something out of the ordinary.

6. Explore a different audience.

Chances are strong that you haven’t fully tapped into all the audiences who might be interested in your brand. These could be niche offshoots of your regular audience or a completely different audience than you’ve sold to before. Being able to conquer yet another target market can give new life to your revenue.

Unsure how to come up with new-to-you audiences? Conducting some social listening can be a good way to start. Find out what your customers are saying about your product online. Then, find out what they’re saying about your competitors’ products. You may unearth some hidden audiences that you’ve never marketed to.

Lucky Charms experienced this when the brand realized it wasn’t marketing to a huge segment of buyers. It turns out, adults like the fun marshmallows almost as much as kids do! This is why Lucky Charms has been making its ads more adult-friendly for a decade. No doubt its revenue reflects its sweet revelation.

7. Improve your brand presence.

People can’t give you their hard-earned money if they don’t know you exist. Putting a push on your outbound content marketing and publicity messaging can put your company name in front of consumers. The more common your brand becomes, the more synonymous it will be with the products or services you offer.

A rapid way to establish your brand presence and reputation is through social media. Staying active on the social media sites preferred by your target buyers should give you a little steam. You’ll just need to make sure you’re posting and commenting regularly. Social media is about engagement, not just sales. The more give and take you provide, the more buzz you’ll build.

You can amplify your social media presence through influencer marketing and paid advertising. Used in tandem with organic content deployment, influencer marketing, and ads will strengthen your credibility. Ultimately, you’ll get a nice lift that should carry over into your sales.

8. Adjust your pricing.

Your price points will affect your revenue. Even if you’re wary about moving your price up or down, take it into consideration. Never assume that you’ll lose customers if you move the needle up, either. Many customers who like what you offer won’t have a problem paying a little more. As noted by The New York Times, consumers rarely jump ship as long as your price raise doesn’t go overboard.

One caveat, however: Be careful about raising prices without warning, especially if you have regular customers. A customer who buys from you once a week or month will notice a price hike faster than one who buys occasionally. Giving notice that your prices will go up shows customers you’re thinking of their needs. Additionally, it makes them feel like you’re not trying to pull a fast one.

Still, feeling uncomfortable at going higher? Give your best shoppers a chance to continue buying at the same low rate for a limited time. Or, keep prices the same for items that are purchased in multiple quantities.

Your company’s revenue is a line item that you have more control over than you may have thought. If you want to see it rise, take action now. With some changes, you could be revenue rich and more profitable than you thought possible.

Published First on Due. Read Here.

Featured Image Credit: Photo by Monstera; Pexels; Thank you!

Due

Know exactly how much money you will have going into your bank account each month. No tricks, no gimmicks. Simple retirement for the modern day human.

You may like

-

Four ways AI is making the power grid faster and more resilient

-

The growing signs of trouble for global carbon markets

-

Plastic is a climate change problem. There are ways to fix it.

-

15 Proven Ways to Increase Customer Engagement and Build Loyalty

-

Four Clever Ways to Use Tiered Pricing for Maximum Profit

-

NSA launches AI security center amid growing cyber threats

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.