Politics

Early Days of the Metaverse in the Built World

Published

2 years agoon

By

Drew Simpson

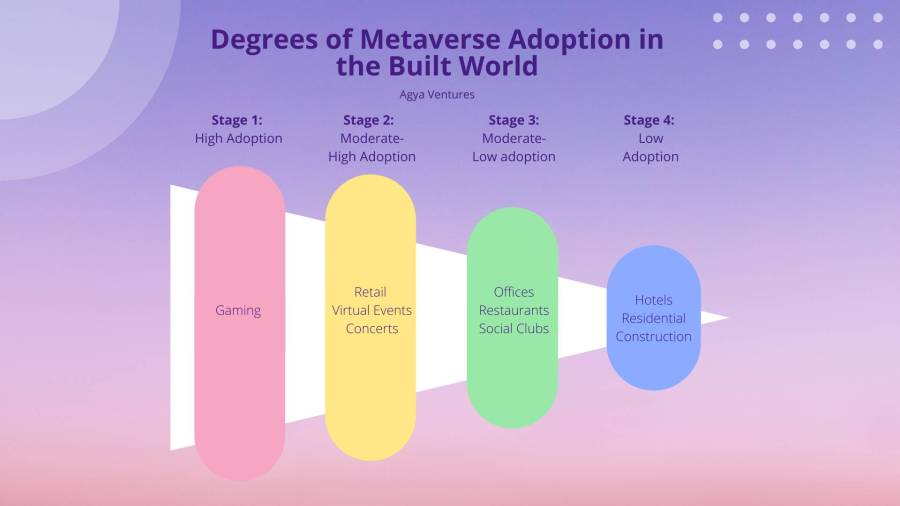

The metaverse isn’t created equal if we look at its adoption across sectors: gaming, retail, virtual events, and concerts have been quick to adopt it — even in early-stage implementation. On the more nascent side of the metaverse adoption spectrum sits office, residential real estate, and hospitality, which are just beginning to see possible use cases emerge over the past few months.

The metaverse is, according to Facebook, a set of virtual spaces where you can create and explore with other people who aren’t in the same physical space as you. While the metaverse concept itself is nothing new, it has gained traction over the last several months. It is a confluence of enabling technologies such as AR/VR, blockchain, and NFTs that have made significant progress.

As with any new technology adoption, some inflated expectations are due for the metaverse. However, the fact that some of the world’s leading companies like Meta and Nike and numerous entrepreneurs are putting their best effort into building the metaverse makes it likely that it’s a frontier in the technology ecosystem for the next decade to come.

The World’s Largest Technology Companies Making Major Strides

The world’s largest technology companies have made significant strides in the past few months — from Facebook changing its name to Meta to Microsoft acquiring Activision Blizzard.

Consumer brands like Adidas and Nike are creating their own metaverse experiences. For example, Adidas next collection will be a combination of digital and physical items and will be sold as NFTs produced with collaborators such as Bored Ape Yacht Club.

Nike, meanwhile, acquired virtual shoe studio RTFKT in December and is building a “Nikeland” metaverse inside Roblox.

Think, Friends Shopping or Gaming Together in the Virtual World

Technology is emerging for the retail sector to adapt virtual shopping and social commerce — even in the earliest innings of metaverse adoption, businesses were beginning to merge VR.

The most tremendous adaptation has arguably been in the gaming industry. This shouldn’t come as a surprise, given that gaming infrastructure is conducive to creating and exploring the virtual world with others.

What Will the Metaverse Do for the Office?

The metaverse offers virtual coworking opportunities for the office, allowing employees to use immersive collaboration and communication tools to create a more connected work-from-home environment.

What about the built world? The metaverse is still coming into form. There is a wide range of adoption levels within the built environment across asset classes and use cases. At Agya Ventures, a VC fund focused on early-stage tech companies; this is how we see the metaverse impacting different industries at various stages of adoption.

Stages of Metaverse Adoption in the Built World

Moderate to High Adoption

Retail

While gaming is at the forefront, or high adoption stage, of metaverse adoption, close behind is the retail industry. The rise of e-commerce, and the digital infrastructure that has come with it, has eased the transition from brick and mortar retail to metaverse retail.

Several luxury brands have already dedicated significant resources to leading the transition, most often by combining NFT ownership with digital or physical products. To name a few, Gucci partnered with Roblox to design a virtual Gucci Garden; Burberry created a line of NFTs for purchase in gaming worlds, and Balenciaga is selling digital skins in Fortnite.

Traditional brick-and-mortar has also seen disruption. Obsess, an Agya Ventures portfolio company, uses AR/VR technology to make physical spaces shoppable through the metaverse. While sales at traditional brick and mortar stores have been decreasing for the past few years, the metaverse is working to bridge the digital and physical gap, providing a new experience for shoppers.

Virtual Events

In-person events such as conferences, conventions, and other get-togethers experienced a never-before-seen decline with the onset of the pandemic.

Collaboration and engagement suffered greatly, which further accelerated the virtualization of large gatherings. Technology increasingly brings people together in ways that don’t require travel and physical presence.

One player in the space is Airmeet, a platform for virtual summits, meetups, and workshops that includes a social lounge for authentic networking experiences. Hopin is also disrupting the events space by providing virtual and hybrid event technology for various use cases.

Concerts

Concerts are often associated with large in-person gatherings in physical spaces like concert halls or stadiums. But just as with other events, the pandemic forced artists and spectators to move towards other forms of media while maintaining the same exclusive feel of a concert.

Many artists have gotten creative: Megan Thee Stallion, for example, recently announced her plans to partner with AmazeVR, a tour that will allow fans in 10 U.S. cities to gather in movie theaters and strap on VR headsets and watch the rapper perform a pre-recorded set.

Several gaming platforms have also introduced concerts for their users, including David Guetta in Roblox and Travis Scott in Fortnite. By creating an immersive and exclusive experience, the metaverse could continue to pick up steam for artists looking to engage with their fans in new ways.

Moderate to Low Adoption

Offices

Leading the way in this third level of metaverse adoption are offices. The pandemic has made it well known across the world that work doesn’t always need to occur in physical offices.

Instead, virtual collaboration and communication have proven effective for work, which has provided a significant tailwind for possible metaverse applications in the office. Two areas in particular that are proving particularly effective include the following.

Web-based virtual offices are web-based platforms and applications that users can deploy in or out of the office. Recreating some of the community and collaborative feel of a traditional work environment, these “offices” are similar to a “next-generation” Slack or Teams. Startups like Gather, a video chat platform, are leading the way.

Another example is VR-based immersive offices, which are far more disruptive to traditional work formats. These require workers to put on VR headsets and engage with colleagues as avatars in a virtual world.

While this is more immersive and potentially more akin to an in-person environment, it also requires adapting to a new way of working. Meta aims to facilitate this with their Horizon Workrooms product launched last year.

Restaurants

The restaurant industry is another (unlikely) space that has begun to see traction with metaverse technology. Dining is different from work and entertainment because it can’t be moved entirely online. Yet, many web3 technologies and concepts are being applied to restaurants in a way that could shape the future of dining out.

For example, Flyfish Club is a member’s only private dining restaurant in Manhattan, where membership is purchased on the blockchain as an NFT. This NFT could also unlock exclusive metaverse-native experiences in the future.

Restaurants are also plugging into web3 via DAOs.For example, Dinner DAO was created in 2021 as a dinner club for online friends to meet IRL. While these experiences are only accessible to web3-native circles, the application of the Metaverse to dining experiences is promising.

Social Clubs

Social clubs are another type of asset class that has started to tap into the exclusivity use cases of the metaverse and web3. Similar to restaurants in nature, several companies have recently formed to create something to the tune of “NFT-enabled Soho Houses.”

These are social clubs where membership is bought and sold on-chain via NFTs, which could also provide access to different metaverse spaces and experiences in the future. For example, Maxwell Social, a token-gated social space in New York’s Tribeca neighborhood, features liquor lockers and open cooking spaces for members.

Low Adoption

Hotels

Many industries are still in the infancy stage of metaverse adoption, including the hospitality industry, and hotels in particular. However, we are starting to see potential ways that the metaverse could impact the industry going forward.

It helps to consider the application of metaverse technology for hotels in terms of front-end and back-end.

The front end is the consumer-facing side of the metaverse and is meant to be accessible by a broad audience (including those without deep knowledge of NFTs and crypto).

For hospitality, this might take the form of virtual entertainment, where hotel guests have exclusive access to virtual events (like concerts) that can be enjoyed from the comfort of a physical hotel room.

These experiences have started to emerge but are a long way from becoming standard. So while the industry has seen growing adoption of chatbots and virtual assistants, there’s a long way to go in terms of the metaverse.

The back end of the metaverse is what happens at the operational level. This might look like payment systems that are compatible with crypto wallets, crypto rewards for frequent stays, or NFTs that function as keys to reserving rooms and accessing events.

Residential Real Estate

Residential spaces have experienced little exposure to metaverse technologies relative to other built world examples. Yet one vertical that is becoming increasingly virtual is property tours. Matterport, for example, is making expensive and time-consuming tours more streamlined by virtualizing homes and apartments for easy viewing.

This allows potential buyers to experience a full property tour from the comfort of their (current) home. Additionally, several VR-based technologies make residential properties easier to experience for design and renovation purposes.

Construction

In an industry that has been slow to adopt even the simplest forms of technologies, construction is still a way from seeing widespread metaverse use cases.

We have seen some potential for the metaverse to enhance digital twin technology, with team members able to immersively interact with these 3D replicas either in the office, at the jobsite, or both.

Companies like IMAJION and The Wild are building metaverse or metaverse-adjacent products for the AEC industry that have started to see some traction.

Conclusion

While the adaptation of the metaverse hasn’t been unilateral, industries across asset classes are embracing it, inspired by the tremendous and multifaceted use cases it presents.

We’re in the early days of implementation: Time will determine the extent of innovation the metaverse will bring to modern society.

Image Credit: ThisIsEngineering; Pexels; Thank you!

Nobu Iguchi

Nobu Iguchi is a Co-Founder and Managing Partner at Agya Ventures. Prior to Agya Ventures, he worked at Bridgewater Associates. Nobu holds a BS in Chemistry from Yale College and an MBA from Harvard Business School.

You may like

-

Mark Zuckerberg in the Metaverse: fantastic or frightening?

-

Top Web Development Companies: Innovative Leaders of the Digital World

-

The Download: metaverse lawyers, and Meta’s twitter clone

-

The Emergent Industrial Metaverse

-

The Impact of Metaverse on Mental Health: A Promising Solution

-

The Download: lab-grown chicken, and rewilding the world

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

6 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

6 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

6 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.