Politics

Healthcare Technologies: The Safest Investment of the Decade

Published

1 year agoon

By

Drew Simpson

The integration of software in the healthcare sector increases the potential to improve access to healthcare on a global scale. With our progression as a species, healthcare technology is transforming the way we diagnose, treat, and prevent disease.

As we evolve and adapt, our lifestyles and daily habits change too, both on an individual level and as a society. We’re living in more urban areas than ever, and the World Health Organization estimates that two-thirds of the global population will be living in urban areas by 2050.

Health will Always be a Priority

The increasing global population, particularly in urban areas, is adding more pressure on healthcare systems, medical establishments, and clinicians. A growing prevalence of mental health issues and rising risk factors such as smoking, insufficient exercise, and poor diets have led to non-communicable diseases such as cancer, diabetes, and heart and lung disease accounting for 70% of global deaths. In other words, our busier and more stressful lifestyles are affecting our physical and mental health.

With 15% of the global population suffering from mental health or substance use disorder, it is apparent that the burdens on our mental health are increasing. Therefore, it is critical for our well-being that we evolve our mental health prevention, treatment, and care services.

In order to improve outcomes for patients across the globe, new channels of investment opportunities are required. The issue of access to healthcare in more vulnerable regions of the world can be addressed by utilizing the benefits of evolving technologies and the roles they play in healthcare.

Health Tech Investment Saves Lives

Primary healthcare can be strengthened via more investments, and consequently, the inequality to access is reduced. The United Nations estimates that around 60 million lives could be saved over the next decade if the annual spending on primary healthcare in low- and middle-income countries was upped by just 5%.

As the world is becoming more and more digital, these budgets are being directed towards the technological side of healthcare, i.e., health tech, and the manners in which this sector can be beneficial and financially efficient.

More resources need to be invested in core health priorities and systems in order to achieve Sustainable Development Goal 3 (SDG 3), “ensure healthy lives and promote well-being for all at all ages.” Billions of lives could be saved since at least half the global population today does not receive the quality health services they need.

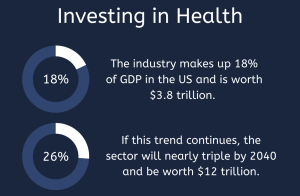

It is a Crucial Investment in the Wider Economy

Even in the more fortunate regions of the world, when people are dealing with untreated diseases and/or don’t have the right support for disabilities, they are less capable of performing, thus impeding their productivity. It, therefore, goes without saying that poor healthcare, in general, will drastically impair productivity. This then further hinders job prospects and, overall, negatively affects capital development.

The COVID-19 pandemic hit us hard economically, and with the urgent need for things to return to normal, investors turned to healthcare as a respite. The world relied on innovative vaccines to rescue us, which eventually led to businesses being able to reopen and flourish once more.

Furthermore, universal health coverage would allow all people to access the quality health services that they need without the risk of financial impoverishment, thus helping boost the global economy.

What is Healthcare Tech?

The World Health Organization defines health tech as an “application of organized knowledge and skills in the form of devices, medicines, vaccines, procedures, and systems developed to solve a health problem and improve quality of lives.”

AI has the ability to organize and collate global health data and help clinicians develop better patient care based on their individual attributes. It is revolutionizing healthcare, and these technologies have the potential to radically improve access to healthcare on a global scale.

The integration of technology-enabled products and services in healthcare is successfully nurturing the health tech industry. It is transforming the way we can diagnose and treat diseases, as well as enabling us to prevent and even predict them.

Devices at home

Health tech investment has enabled the development of wearable products such as smartwatches that can track seizures or monitor body temperature and detect early-stage viruses before symptoms even present. Diabetes sufferers can now be warned of alternations in glucose levels ahead of time, thanks to IBM’s Watson Health.

Wearables can improve daily life and have the potential to help employers vastly improve productivity. The ability to track basic health at home allows preventative measures to be taken. Fending off sickness means less work time is lost, which in turn can save economies billions of dollars.

Facilitating and Enabling Healthcare Functions

Elderly patients can socially interact with AI and robotics, helping them feel less isolated. Their quality of life enhances, and they can feel more independent for longer. By being able to look after themselves for longer and in a healthier state of mind, the economic burden on care homes and healthcare systems within aging populations is significantly lightened.

Health tech companies can facilitate and provide anything from predictive analytics and medicine and electronic medical records to training for health providers and vaccine delivery and storage.

While individual companies fulfill specific needs such as digitizing core processes, creating clinical trial management software, and providing digital health solutions, the industry as whole covers anything from pharmaceuticals and medical technology down to healthcare providers themselves.

A Safe Investment

While significant advancements in healthcare have increased our lifespan and enabled us to live healthier lives, we are continuously being confronted by infectious disease outbreaks and seasonal recurrences that only remind us of our dependence on the healthcare sector.

This sector has historically held up during times of market uncertainty, and the wide variety within the health tech industry ensures that returns on any investments are predictable and guaranteed. This makes it safer than investing in an individual company or product that fulfills one specific need. People will still be needing and using these services in 10, 20, and 50 years.

Healthcare tech and AI-driven advances are at the forefront of the fight against illnesses and diseases. They are opening new pathways for the vulnerable to access high-quality healthcare. As we evolve and develop, we will keep facing new diseases that require healthcare, making this a safe sector for decades.

Being Prepared

The world spends more money each year responding to health emergencies and disease outbreaks than it does preparing for and preventing them. Over $40 billion in productivity was the estimated economic and social cost of the SARS epidemic, and the West African Ebola outbreak between 2014-2016 was estimated at $53 billion. By investing in preparedness and not panicking, we can prevent these huge financial losses.

In the digital and information age we now live in, technology is the focal point. It takes up a major part of our daily lives, and as the world becomes increasingly more digital, it will only continue to make up more of who we are and what we do.

Making Diagnostics More Accessible

The way we reach and treat patients in all corners of the globe has been transformed by rapid changes in technologies and the trend of making devices smaller and more accessible.

Virtual health is being expanded to provide care and support at any time and location, assisting with physical challenges like distance and accessibility. When used in conjunction with wearable technologies, information can be shared with clinicians to assist the process.

Diagnostics influences 70% of healthcare decisions, yet they currently only receive 3-5% of healthcare spending. By simply improving blood glucose measurements, diabetes detection can be improved in among 50% of people in low- and middle-income countries.

Humanitarian Investments

The health and fitness wearables market has tripled in the US alone over the past four years, and research suggests that it will grow at an annual 10% to surpass 120 million users by 2023.

As humanity continues to move forward, both the healthcare and technology sectors will always exist in one form or another. The ever-growing technology companies are always looking for ways to advance society in meaningful and creative ways, and health tech can provide successful financial returns as well as humanitarian outcomes.

Healthcare Tech is Here to Stay

In 2019, billions of dollars were invested in more than 100 digital health companies, according to Forbes. Furthermore, governments are also investing in digital healthcare and saving billions of dollars that they can reinvest in front-line care.

The private sector has made a great impact in low- and middle-income countries, emerging as a key player in research, development, and deployment. The current pace of innovation in healthcare technology promises private investors the opportunity to capture real growth value.

In order to truly capitalize on the potential of healthcare technology, new channels of investment are required. Together with novel ways of collaborating with new models of service delivery, we can improve the outcomes for patients across the globe.

Featured Image Credit: Provided by the Author; Thank you!

Jimmy Ahern

Founding Partner at Lucius Partners, LLC, Founder of Laidlaw Venture Partners, and Managing Partner of Laidlaw & Company (UK) Ltd., James “Jimmy” Ahern is and expert in private equities, capital markets and venture capital with a focus on health tech and biotech. Having built the company’s portfolio by creating relationships with innovation laboratories at several universities, Jimmy has been instrumental in the incubation of several corporations.

You may like

-

5 things we didn’t put on our 2024 list of 10 Breakthrough Technologies

-

XII Emerging Technologies that are Helping SMBs Grow in 2023 and Beyond

-

Top 10 Worst Paying College Majors: Making an Informed Investment in Education

-

AI Brings New Capabilities and Risks to Healthcare Data Security

-

Can Hybrid Intelligence Opens Up New Opportunities In Healthcare

-

Best UEBA Use Cases to Implement in Healthcare

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.