Politics

How the Launch of Two Story’s Performance Analytics Tool Will Change How You Hire

Published

1 year agoon

By

Drew Simpson

If your business is just getting big enough to bring on full-time employees, hiring might be an exciting prospect. You get to search for the best people to build your vision and take things to the next level.

After a while, though, hiring can be a bit of a slog. You have to painstakingly craft a job description and figure out how to advertise it to get noticed by the right people. If you’re lucky enough to get multiple qualified candidates, there are numerous rounds of interviews and tough decisions.

Then despite your time and effort, your hire may or may not work out. Their actual abilities may not match up with the promise of their resume. Or your hire’s personality might be a poor fit for the work culture you’ve established. Or perhaps the new employee decides it’s not the right role for them after all. The hiring cycle begins again.

After a few rounds of hiring, the process tends to lose its luster. Technology has tried to help find employees most suited to a business’s needs; this has come in the form of personality tests. These tests have been used for years by companies, and are not always useful in the hiring process. But overall, technology in hiring hasn’t progressed much since—at least, not in any widespread manner.

New hiring tech tools are starting to appear, however. Two Story—a performance analytics innovator—has been seeking to find a better way to match employers with candidates. This new hiring solution is called Performance Story.

Using a robust combination of behavioral assessment and skill analysis, Performance Story uses the newest findings in machine learning and behavioral science to diagnose what each role needs and predict a candidate’s fit. When used properly, this tool can change the way businesses hire.

Creating A Story Rather Than A Profile

Performance Story, as its name implies, gives a comprehensive picture of an employee rather than a list of attributes. It’s a huge advancement that better reflects the complexity of humans. Performance Story avoids boiling candidates down to their skills and whether or not they’re extroverted–which has never given a complete picture.

Performance Story looks at a job seeker’s talent profile to evaluate their predictive job fit and what potential they may have. Gaps in that profile can be filled after the candidate completes Two Story’s behavioral assessment. These assessments use non-obvious questions to get to the root of a person’s behaviors, values, acumen and habits. They also can give insight into how well they handle criticism and confrontation.

Traditional personality tests tend to have obvious and leading questions. Candidates may be tempted to answer in the way they think will get them the job instead of answering honestly. So if an employer is looking at a resume with vague language and a faulty personality report, it’s harder to predict job fit.

Knowing what makes a person tick can also help employers communicate expectations on both sides. Maybe a candidate has a history of leaving jobs after about two years, which is lower than the US average. It’s possible even the candidate doesn’t know why that pattern has emerged. Performance Story can play a huge part in providing an explanation and a remedy.

Reviewing The Candidate’s Story

Performance analytics could show the person in question needs a clear advancement path to remain engaged long term. Performance Story generates a list of key questions to ask interviewees in order to confirm or adjust candidate profiles. In this case, it might not be useful to ask the interviewee about a time they overcame adversity at work. It would be far more insightful to inquire if they’ve ever had a path of advancement in their prior jobs.

If they’ve never had a clear career path with their past employers, it might provide a mutually beneficial solution for everyone. The prospective employer would need to review and assess performance analytics to see what advancements are possible for that person or position within the business’s five-year projection. If advancements are feasible, then it needs to be clearly relayed what the employee will need to do in order to attain them.

Additionally, the interviewee has had career advancement laid out by previous employers, then something else is behind the job hopping pattern. If the candidate’s short tenure tendency is not something employers can easily fix with job modifications, they may not be a good fit.

If The Employee Succeeds, Everyone Succeeds

One of the central aspects of Performance Story is asking a very simple question for candidates. What type of placement is going to give each person the best chance of success? And this goes far beyond the basic functions of the job itself.

For example, let’s say a business named Pencil Supply is growing and needs to hire an HR and benefits coordinator. Performance Story’s AI systems can isolate key traits of successful HR coordinators and factor in variables relating to Pencil Supply internal nuances. Although it may seem counterintuitive, that process can actually open up the hiring pool to a greater number of applicants.

In Pencil Supply’s case, maybe they were previously requiring applicants to possess a master’s degree or MBA. Performance Story might reveal that the most successful HR leaders have at most a bachelor’s degrees and, more importantly, one specific personality trait. That vital information could inspire Pencil Supply to lower the education requirement and get more applicants in the system.

Another game-changing facet of Performance Story is its predictive capabilities. The powerful combination of behavioral analytics and AI projections will first assess performance analytics on how a candidate might perform in a certain position. Next, it provides information to the employer about how they can customize their processes to get the best output from their new hire. From job responsibilities to career path to education opportunities, employers will know what will keep an employee on board and engaged.

Very rarely is an employee’s success in the workplace one-sided. If an employer has predictive analysis on their side to keep a worker engaged for the long term, they can minimize turnover. When an employer places emphasis on the success of their individual workers, the company as a whole should see the benefits.

Using Science, Not Guesswork

There are all sorts of vague ways that employers or hiring managers make hiring decisions. They can be based on feelings, first impressions, or the candidate being the local mayor’s sister-in-law. Those methods may be better than pulling a random resume and extending an offer, but data and analysis can change the game. Using an approach that offers performance analytics, behavior analysis, and AI predictive abilities can make hiring more efficient and facilitate a better job/candidate fit.

So if you want to keep long hiring cycles and high turnover rates, keep doing what you’re doing. For better results and less headache, change the way you hire.

Featured Image Credit: by RODNAE Productions; Pexels; Thanks!

Brad Anderson

Editor In Chief at ReadWrite

Brad is the editor overseeing contributed content at ReadWrite.com. He previously worked as an editor at PayPal and Crunchbase. You can reach him at brad at readwrite.com.

You may like

-

Google DeepMind’s new AI tool helped create more than 700 new materials

-

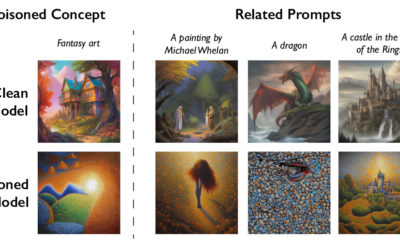

This new data poisoning tool lets artists fight back against generative AI

-

Plastic is a climate change problem. There are ways to fix it.

-

US approves chip tool exports to China for Korean giants

-

Data analytics reveal real business value

-

PMaps Pre-employment Assessment Tool to the Rescue

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

6 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

6 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

6 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.