Politics

Knowing When to File for Bankruptcy

Published

2 years agoon

By

Drew Simpson

Life doesn’t always go according to plan. You may have needed to take on debt that outgrew your ability to pay it off each month. Now you’re wondering how to get your financial situation back in order.

Knowing when to file for bankruptcy is a valuable skill for individual consumers and small-business owners. Learn more about it and determine if it’s the best move for your financial needs.

What Is Bankruptcy?

Bankruptcy is a legal process begun by people who have too much debt. They must sign a federal petition that considers their outstanding financial obligations or debts before requesting that their creditors work with them to resolve their debt with any remaining assets.

What Are the Types of Bankruptcy?

People can accrue too much debt as individual consumers or business owners, so numerous types of bankruptcy exist to address those situations. These are the specific chapters outlined in the U.S. bankruptcy code that you may consider if you find yourself unable to repay debts.

Chapter 7: Individual Liquidation

Most people who need to claim straight bankruptcy over personal debt will file under Chapter 7. A federal court appoints a trustee to assist the individual with selling property to repay lenders or creditors. You can claim specific property exempt from Chapter 7 bankruptcy, like your car, pension, or household equity.

Chapter 11: Reorganization Bankruptcy

Small-business owners may be able to file Chapter 11 bankruptcy to reorganize their assets, affairs, and debts. If the collection of these factors exceeds $5 million, an examiner will step in to guide you through the process.

This can be a helpful step for business owners because it allows the company to remain open and operational while restructuring occurs. Creditors can also propose a Chapter 11 bankruptcy if the debtor doesn’t offer the idea first.

Chapter 13: Asset Maintenance and Repayment Plan

Individuals who file for Chapter 13 bankruptcy can keep their assets but must repay their debts within three to five years of a court approving their plan. You won’t have to liquidate anything if you don’t miss or skip any payments. Most people who don’t receive approval for this bankruptcy are workers without reliable sources of income.

When to File for Bankruptcy as an Individual

Before filing for bankruptcy, it’s essential to negotiate with your debtors or creditors. They’ll still get their money back if there’s a way for you to make long-term payments and eventually pay off your debt more efficiently.

Sometimes debtors will negotiate for that reason. However, they may not if they don’t see a viable path forward due to your financial history or situation.

When negotiating isn’t possible, and you’re about to lose your house or other essential assets because you can’t make monthly payments, it may be time to file for bankruptcy. First, schedule a credit counseling session to get the correct certificate for your requested type of bankruptcy.

A counselor will review your assets and liabilities during that session and find the best solution for your needs, even if that isn’t bankruptcy. You can find these experts by reaching out to federal credit counseling agencies.

You might feel worried that your property or existing net worth won’t be enough to pay off your debts. If that’s the case, your senior-most credit facility will establish a financial solvency plan to remedy the remaining debt owed alongside your credit counselor. By working out any necessary amendments, your minority lenders will follow the senior-most decisions if they create the plan in good faith.

When to File for Bankruptcy as a Business

When debtors don’t negotiate with small-business owners regarding their loans, it could be time to file for bankruptcy. Typically this would mean a Chapter 11 case, which has a few pros and cons for people operating small companies.

You may benefit from this type of bankruptcy if your creditors or debtors don’t meet to discuss new contract terms. Instead, the federal case would bring everyone to the same table to discuss options like extended payment terms for real estate, equipment, or manufacturing loans.

Small-business owners also don’t have to immediately liquidate their companies or assets to pay off the debt. Instead, they can remain open and operational because Chapter 11 prioritizes repayment plans approved by federal courts. A trustee becomes the facilitator monitoring the ongoing payments after both parties reach agreed-upon terms.

Small-business owners hesitate to file bankruptcy because it can become an expensive, drawn-out process. Depending on the court’s calendar and how easily debtors agree to payment plans, you may pay an average of $19,738 just for filing and attorney fees.

Additionally, you would have to make initial payments within the first few months of your plan agreement. That can be challenging after paying legal fees while continuing your daily business operations.

How to File for Bankruptcy

Many steps are involved with filing for bankruptcy. First, familiarize yourself with the process before making any final decisions.

1. Review Your Options

Remember, bankruptcy might not be necessary for your situation. Discharging debts like student loans and unpaid taxes will provide relief while you look into consolidation or settlement. You’ll need your financial history and credit report paperwork to make the best decision.

2. Choose the Bankruptcy Type

If you decide that bankruptcy is right for you or your business, you’ll need to choose from Chapters 7, 11, or 13. Individual or business bankruptcy is the first way to narrow down your options. Afterward, you can decide based on your assets’ value, outstanding debt, and ongoing income.

3. Decide on Finding an Attorney

The American Bar Association and state associations have lists of attorneys ready to assist people with filing for bankruptcy. Legal aid clinics and free services can also help if you can’t afford legal assistance but desire representation.

The option to represent yourself is also called going pro se. You won’t have to pay attorney fees, so you’ll save most of your filing costs. However, you may not receive the debt relief you need. A recent study found less than half of pro se cases resulted in debt discharge, while 93.9% of represented instances did.

4. Pass a Credit Counseling Course

Everyone filing for bankruptcy of any type will have to attend a credit counseling course. It helps people weigh their options to determine the best action, whether that’s bankruptcy or other types of debt relief. If you finish your class more than 180 days before filing, you’ll have to retake it closer to your official filing date.

5. Complete Your Counseling and Legal Forms

After meeting with credit counselors and completing your course, you’ll have to fill out all related forms. There are many involved with any bankruptcy, so prepare for this step to take some time. The forms include your financial history, statements, fees, and other related information. Your lawyer can help if you choose to get representation.

6. Pay Fees and File Forms

Your paperwork also comes with many fees. There are charges for filing, administrative work, and even surcharges if a trustee will oversee the payment plan arrangements with your debtors. Sometimes people can get these fees waived, but only if their income is 150% below the poverty line determined by a federal court.

7. Negotiate With Your Creditors

Whether you appear in court or not, your creditors will sit down with you after you pay your fees and file all necessary paperwork. They will review your situation and determine how best to repay your debts. Any agreements made at this point will be legally binding, as the meeting happens under oath.

8. Attend Debtor Education Classes

You must complete post-filing education classes if your lenders discharge your debts. This guarantees you’ve learned how to manage your finances better based on your academic performance in the lessons and tests. You’ll need to pay the class fee and earn the final certificate to complete your bankruptcy.

What Life Looks Like After Filing

What will your life look like after completing bankruptcy? It depends on how you file and your situation.

Chapter 7 bankruptcies remain on credit records for a decade after both parties resolve the outstanding debt. On the other hand, a Chapter 13 bankruptcy will only stay for seven years.

You’ll also reduce your credit score no matter how you decide to file. That could make it more difficult or impossible to get money from insurance companies and investors if you need to expand your business or recover from an emergency.

If you face significant debt immediately after experiencing bankruptcy, you may have to shoulder it alone for many years. There are limits to how often people can file specific bankruptcy chapters.

Debts That Don’t Count Toward Bankruptcy

You may not need to file bankruptcy if you owe money for reasons that don’t qualify. Here are a few types of debts that federal courts don’t count in bankruptcy filings:

- Outstanding utility bills

- Personal loans

- Credit card debt

- Medical bills

- Payday loans

- Past-due rent bills

Reaching out to legal representation or credit counselors will help determine if your debt qualifies for bankruptcy or if you need alternative solutions.

Know When to File for Bankruptcy

Knowing when to file for bankruptcy is essential to managing your finances. It could make things brighter or not be part of your future. Talk with an expert to see if it’s the best way to manage your debts while maintaining your personal or professional life.

Published First on Due. Read Here.

Featured Image Credit: Photo by Nicola Barts; Pexels; Thank you!

Due

Know exactly how much money you will have going into your bank account each month. No tricks, no gimmicks. Simple retirement for the modern day human.

You may like

-

File Systems in the Cloud: AWS EFS vs. Azure File Storage

-

How to Avoid Bankruptcy in Crypto

-

Lululemon workers in Washington D.C. file for a union election

-

‘I’m out millions of dollars’: Countless crypto investors have their life savings frozen as Voyager files for bankruptcy protection

-

IT security starts with knowing your assets: Europe, the Middle East, and Africa

-

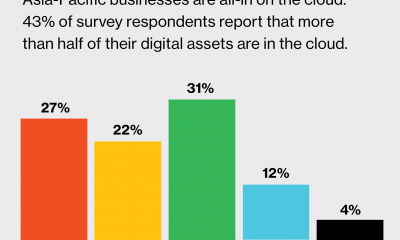

IT security starts with knowing your assets: Asia-Pacific

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

6 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.