Politics

Monday.com Versus Smartsheet

Published

12 months agoon

By

Drew Simpson

In today’s fast-paced business environment, effective project management and collaboration are crucial for the success of any organization. With numerous software solutions available, it can be challenging to choose the right platform to streamline workflows and optimize productivity. Two popular options in the market are Monday.com and Smartsheet.

In this article, we will compare the features and functionalities of Monday.com and Smartsheet, aiming to help you make an informed decision about which platform best suits your needs.

Comparing Monday and Smartsheet

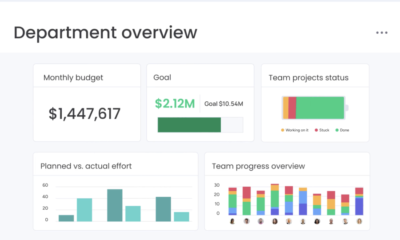

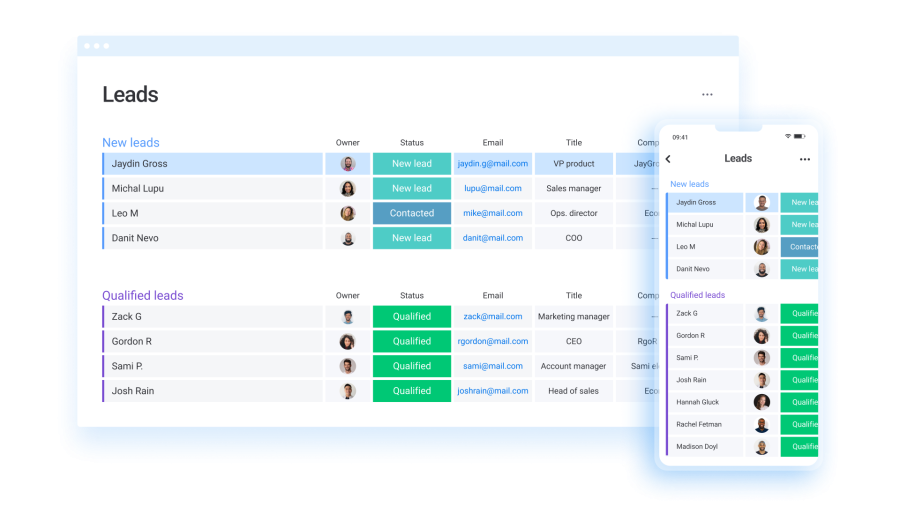

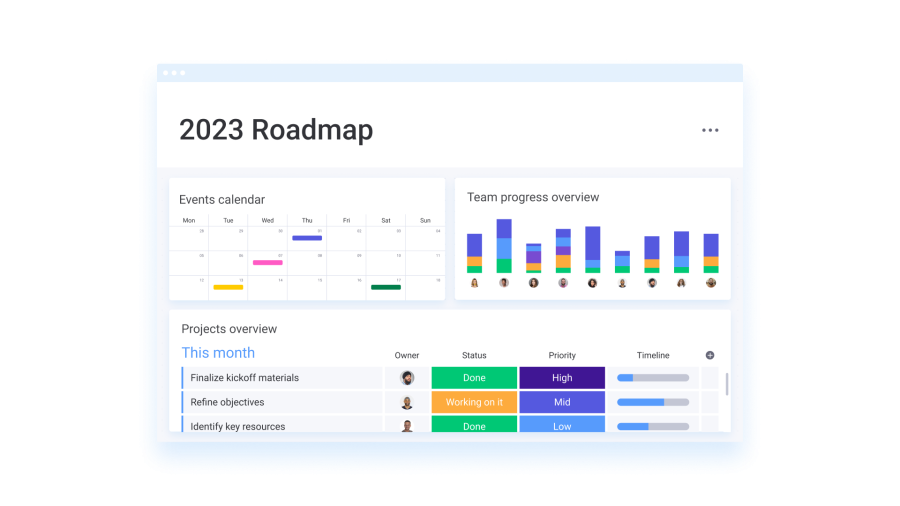

Monday.com and Smartsheet are both powerful project management and work collaboration tools that help teams efficiently organize tasks and projects. Monday.com stands out for its visually appealing, user-friendly interface that employs boards with customizable fields to manage various workflows, allowing teams to view multiple projects simultaneously.

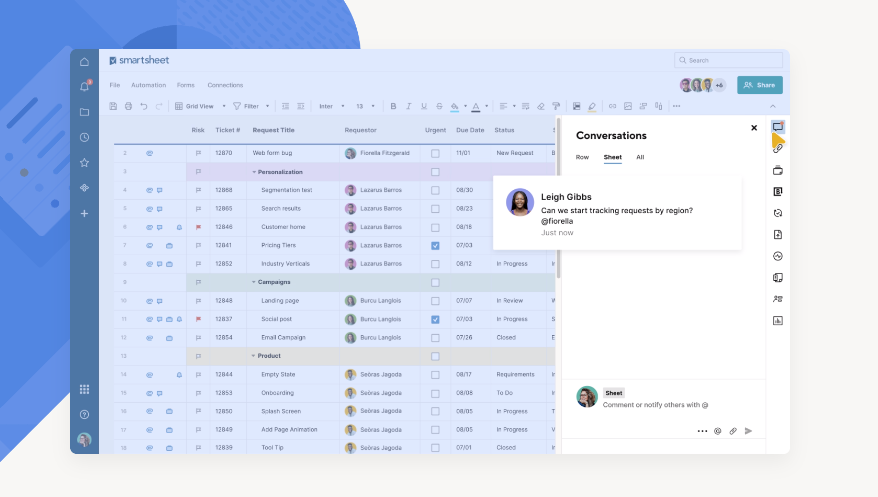

It offers an extensive range of integrations, project templates, and automation features, making it suitable for various industries. On the other hand, Smartsheet provides a familiar spreadsheet-like interface that supports more advanced features, such as Gantt charts, resource management, and powerful reporting tools.

While it might have a steeper learning curve than Monday.com, it is an excellent choice for teams that require comprehensive work management solutions and advanced functionality.

Monday.com Sales Dashboard

In terms of pricing plans, both platforms offer multiple options to suit the needs of different organizations. Monday.com provides four tiers: Basic, Standard, Pro, and Enterprise. The Basic plan starts at $8 per user per month, offering essential features such as unlimited boards, over 20 column types, and access to the Monday.com mobile app.

The higher-tier plans, priced between $10-$16 per user per month, include additional features like timeline and Gantt views, automations, reporting, and more. The Enterprise plan offers custom pricing based on the organization’s specific requirements.

Monday CRM Dashboard

Smartsheet Dashboard

Similarly, Smartsheet offers four pricing plans: Individual, Business, Enterprise, and Premier. The Individual plan begins at $14 per user per month, providing core functionalities like 10 sheets, mobile access, and integrations.

The Business plan, which starts at $25 per user per month, offers advanced features such as automations, reporting, activity logs, and unlimited sheets. Enterprise and Premier plans are available with custom pricing, providing advanced capabilities like resource management, premium support, and increased administrative controls. Overall, the decision between Monday.com and Smartsheet primarily depends on your team’s specific needs, preferences for interface, and budget.

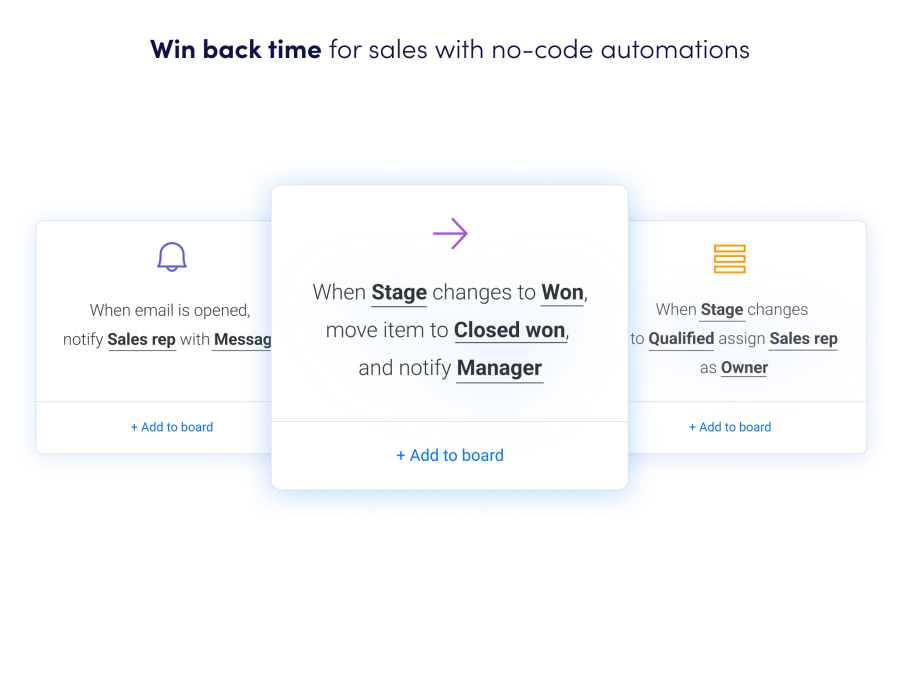

Monday Sales Automations

Pricing Comparison

| Pricing Tiers | Monday.com | Smartsheet |

|---|---|---|

| Basic | Starts at $8/user/month (billed annually) | Starts at $14/user/month (billed annually) |

| Standard | Starts at $10/user/month (billed annually) | Starts at $25/user/month (billed annually) |

| Pro | Starts at $16/user/month (billed annually) | Starts at $35/user/month (billed annually) |

| Enterprise | Custom pricing available, tailored to specific business needs | Custom pricing available, tailored to specific business needs |

Frequently Asked Questions (FAQ)

1. Q: What are Monday.com and Smartsheet?

A: Monday.com and Smartsheet are two popular project management and collaboration tools. Both platforms provide features like task management, team collaboration, and workflow automation to improve project efficiency and organization.

2. Q: How do Monday.com and Smartsheet differ regarding user interface?

A: Monday.com has a visually driven interface that utilizes boards and cards to represent tasks, statuses, and timelines. Smartsheet, on the other hand, has a spreadsheet-like interface, which resembles Excel, providing a familiar environment for those who are used to working with spreadsheets.

3. Q: Are there any major differences in the pricing of Monday.com and Smartsheet?

A: Both Monday.com and Smartsheet offer tiered pricing plans, catering to varying needs of individuals and businesses. Monday.com starts at $8 per user per month, while Smartsheet begins at $14 per user per month. However, pricing may vary based on additional features, storage, and support.

4. Q: Can both Monday.com and Smartsheet be integrated with other productivity tools?

A: Yes, both Monday.com and Smartsheet offer integration with popular productivity tools such as Google Drive, Slack, Salesforce, Trello, and many more to streamline your workflows.

5. Q: Can Monday.com and Smartsheet be used on mobile devices?

A: Both Monday.com and Smartsheet have dedicated mobile apps available for iOS and Android devices, allowing users to manage their projects and collaborate with their teams on the go.

6. Q: Which tool is better for automation and workflow management?

A: Monday.com has a built-in feature called Automation, which allows you to set up automatic actions based on triggers. Smartsheet offers a similar feature called Workflows, which uses conditional formatting rules to automate processes. Both platforms provide automation capabilities; however, the specific tool that best suits your needs will depend on your specific requirements and preferences.

7. Q: How do Monday.com and Smartsheet handle sharing and permissions?

A: Both platforms allow users to set permissions and share their projects within teams and outside organizations. Sharing options can be customized to provide different levels of access and control based on user roles and responsibilities.

8. Q: Are Monday.com and Smartsheet suitable for agile project management?

A: Both Monday.com and Smartsheet can be configured for agile project management methodologies, such as Scrum or Kanban. However, it is essential to customize the platforms and utilize additional features like boards and automation to fully align with agile practices.

9. Q: What kind of customer support do Monday.com and Smartsheet offer?

A: Both platforms provide extensive customer support through different channels like knowledge bases, live chat, email, and phone support (for higher-tier plans). Moreover, they offer user communities and resources for learning and troubleshooting.

10. Q: How do I decide which platform is right for me?

A: It depends on your specific needs, preferences, and budget. Consider factors like interface, integrations, pricing, automation capabilities, and available support while making your decision. It’s recommended to sign up for free trials or demos of both platforms to better understand their capabilities and decide which one fits your team’s requirements.

Conclusion

Choosing the right project management and collaboration platform can significantly impact your team’s productivity and efficiency. Monday.com and Smartsheet both offer powerful features and capabilities to help you streamline workflows, manage projects, and collaborate effectively.

While Monday.com stands out for its modern interface, robust project management features, and extensive customization options, Smartsheet offers a more traditional spreadsheet-like interface, comprehensive project management functionalities, and a focus on task tracking and assignment.

Ultimately, the choice between Monday.com and Smartsheet depends on your specific requirements, team preferences, and the nature of your projects. Consider factors such as user interface, project management capabilities, collaboration features, workflow automation, task management, reporting, integration options, and pricing plans. Evaluating these aspects will help you make an informed decision that aligns with your organization’s needs and goals.

Featured Image Credit: Provided by the Author; Thank you! Inner Image Credits — Provided by the Author; Taken from the Product Websites; Thank you!

Aaron Heienickle

Technology Writer

Aaron is a technology enthusiast and avid learner. With a passion for theorizing about the future and current trends, he writes on topics stretching from AI and SEO to robotics and IoT.

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.