Business

Nancy Pelosi’s Taiwan trip has intensified the US and China’s chips showdown. Now the world’s chipmakers may be forced to pick a side

Published

2 years agoon

By

Drew Simpson

This week, U.S. House Speaker Nancy Pelosi became the highest-ranking American official to visit Taiwan in 25 years.

Her trip boosted U.S.-Taiwan relations at a time when Washington’s ties with Beijing are becoming increasingly frayed. Pelosi vowed that the U.S. would protect Taiwan’s democratic self-rule. “America’s determination to preserve democracy here in Taiwan remains ironclad,” she said in a Wednesday meeting with Taiwanese President Tsai Ing-wen.

Pelosi’s politically-charged Taiwan tour ignited Beijing’s fury. China, which considers Taiwan to be a breakaway territory, denounced Pelosi’s visit as “extremely dangerous” to geopolitical stability. Following Pelosi’s visit, Beijing conducted its largest-ever military drills near Taiwan, encircling the island with live rocket and ballistic-missile fire. On Friday, China announced that it’s halting cooperation and dialogue with the U.S. on issues from climate to cross-border crime prevention, illustrating that Beijing is intent on pushing back against the U.S. on what it views as interference in Chinese affairs.

But perhaps most importantly for the business world, the recent events have intensified the growing Sino-American showdown in the global economy’s most vital sector: semiconductor chips. The U.S.-China chips battle, which has already been brewing for years, has now reached a critical crossroads, and experts say that the world’s chipmakers could soon be forced to choose between Washington and Beijing as the two superpowers jostle for technological and economic dominance.

Race to the top

Washington and Beijing are locked in a fierce race to become the global leader in high-tech industries like artificial intelligence, biotechnology and semiconductors. Semiconductor chips, the building blocks that power everything from smartphones, household appliances, to data servers and military equipment, are a primary battleground. Both countries have framed the race to become a chips superpower as critical to their respective national and economic security.

Seven years ago, China launched its ‘Made in China 2025’ blueprint, which outlines its ambitions to dominate advanced technology—including a target to produce 70% of the chips it uses at home by 2025 (though it remains far short of this goal).

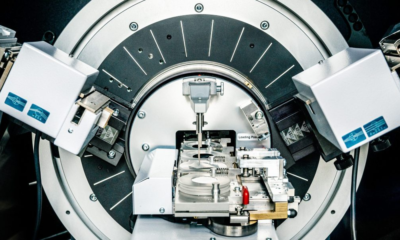

Last week, Washington made a big step forward in its efforts to stay competitive. On July 29, Congress passed the CHIPS Act—a landmark legislation that earmarks $52 billion in subsidies for America’s semiconductor sector, which made clear its intentions to shore up its homegrown chip industry. Around $39 billion will be allocated for building new chip fabrication plants (known as fabs) on U.S. soil.

Pelosi’s Taiwan tour may have scored another point for the American team. Her short trip included a vital meeting with Mark Liu, CEO of Taiwan Semiconductor Manufacturing Company (TSMC)—the world’s biggest and most valuable chipmaker. The firm produces 90% of the world’s leading-edge chips.

So far, TSMC has eschewed taking sides between the two rival countries, because of the importance of both the U.S. and China to its business. But Liu’s meeting with Pelosi signaled a willingness to side with Washington and smashed “any semblance of [TSMC’s] neutrality,” Bloomberg’s Tim Culpan wrote this week.

The culmination of Pelosi’s trip, plus the passage of the CHIPS Act and earlier U.S. export controls that decimated TSMC’s China revenue, has resulted in “an environment where… TSMC’s size and prowess will ensure it remains everybody’s foundry—except China’s,” he wrote.

‘Businesses will have to pick a side’

The culmination of recent events reinforced that businesses could soon be compelled to choose a side in the long-standing tug-of-war between Washington and Beijing.

Beijing’s response to Pelosi’s Taiwan visit—which included trade sanctions on Taiwan—was relatively constrained, Mark Williams, chief Asia economist at research firm Capital Economics, wrote in a Wednesday note. At the moment, China is avoiding any major retaliation because of Taiwan’s importance to the Chinese economy. Electronics make up the biggest share of Taiwanese exports to China, and semiconductors are the single largest product. If Beijing slaps sanctions on Taiwan chipmakers, it would “wreak havoc in Chinese industry [and] may not hurt Taiwan’s producers,” given the heightened chip demand worldwide, Williams wrote.

Still, China’s military display post-Pelosi visit shows that its security interests could supersede global cooperation, Vashistha, founder and CEO of Supply Wisdom, a risk management firm and U.S. Department of Defense’s defense business board, told Fortune. This means that “businesses will have to pick a side, especially when it comes to critical supply chains,” he said.

The Taiwan drama also warned American businesses—chip firms and tech companies alike—that their business relationships with China could be at risk, Paul Rosenzweig, CEO of Red Branch Consulting and former Department of Homeland Security Assistant Secretary for Policy, told Fortune.

The U.S. is now considering restricting U.S. chipmaking equipment from being exported to Chinese memory chipmakers, which would be the first by the U.S. to restrict shipments to those producers that don’t have specialized military applications. The move would hurt global chipmakers like South Korea’s Samsung and SK Hynix, which have memory chip operations in China.

Yet the world’s biggest chipmakers in Taiwan and South Korea are likely inclined to side with the U.S. for a few key reasons, Jon Bathgate, investor at NZS Capital, an investment management firm focused on semiconductors, told Fortune.

The U.S. lags Asia in semiconductor manufacturing, but it remains a global leader in advanced semiconductor design and equipment. The U.S. accounts for over 80% of the world’s chip design equipment, over 50% of the core intellectual property for chip designs, and around half of the globe’s chip manufacturing equipment, according to the Boston Consulting Group. This means that the chip manufacturing powerhouses in Asia need U.S. designs and hardware to produce high-tech chips. Plus, the majority of these chipmakers’ wholesale customers are U.S.-based. The U.S. for instance, makes up 64% of TSMC’s sales. Those top customers include smartphone giant Apple, which accounts for a quarter of the Taiwanese firm’s revenue.

“This has given the U.S. a lot of leverage relative to China when it comes to advocating for investment and partnership,” Bathgate says.

Some say global chip giants are already pivoting to the U.S. market. The CHIPS Act, which would bar recipients of U.S. government funds from expanding or upgrading their advanced chip capacity in China, have compelled South Korean firms to review their Chinese operations.

They’re “accelerat[ing] the shift from the U.S. to China,” said Kim Young-woo, head of research at SK Securities and a South Korean government advisor on semiconductor policy, in a Financial Times report published earlier this week. “They’ve been rethinking their strategies because of the U.S.-China technology war and they are now tilting further towards the U.S. because of geopolitical risks.”

South Korean electronics giant Samsung is already building a $17 billion fab in Texas—its biggest-ever U.S. investment—while TSMC is spending $12 billion on an Arizona plant. For global chipmakers, the “key driver” for building plants in the U.S. is “continued access to the U.S. market and technologies,” Bathgate says.

But picking a team may not be so easy.

China remains the world’s largest importer of chips and the biggest buyer of semiconductor manufacturing equipment. By some accounts, China has spent $100 billion on building its chip industry—and its set to spend even more. Shares of Chinese chipmakers surged this week as investors interpreted Pelosi’s visit as a boon to China’s chipmakers that will spur Beijing to plow more money into homegrown manufacturers.

And despite U.S. pressure on chipmakers to stop investing in China and providing the country with advanced chip technology, companies like TSMC need both U.S. and Chinese markets and will “try hard to avoid being forced to choose sides,” Dexter Roberts, senior fellow at the Atlantic Council’s Asia Security Initiative and author of The Myth of Chinese Capitalism: The Worker, the Factory, and the Future of the World told Fortune. TSMC CEO Liu noted that the company and China still depend on each other, he said in a CNN interview this week.

South Korean and Taiwanese companies had pivoted to China previously because of the cheap costs of manufacturing in the country. These chip giants will be leaning heavily on the CHIPS Act’s subsidies, given the high manufacturing costs in the U.S. But as some experts note, the bill’s subsidies, parcelled out in no more than $3 billion grants, may be insufficient to galvanize chipmakers to shift their supply chains in any meaningful way.

Businesses would incur major costs and disruptions from cutting themselves off from China, Rosenzweig says, meaning that “most companies would be very reluctant to consider a complete break with China.”

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.

You may like

-

The Download: AI coding assistants, and China’s app disputes

-

Noise-canceling headphones could let you pick and choose the sounds you want to hear

-

The Download: how NYC tackles tough problems, and China’s AI standards

-

The Download: gene-edited chickens, and China’s green companies

-

Thrilling WeatherTech Raceway Laguna Seca esports showdown

-

The Download: China’s EV success in Europe, and ClimateTech is coming

Business

Coinbase’s near-term outlook is ‘still grim’, JPMorgan says, while BofA is more positive about firm’s ability to face crypto winter

Published

2 years agoon

08/10/2022By

Drew Simpson

Coinbase is well positioned to successfully navigate this crypto winter and take market share, Bank of America said in a research report Tuesday. It maintained its buy recommendation following the exchange’s second-quarter results.

The results warrant “a muted stock reaction,” the report said. Net revenue of $803 million was below the bank’s and consensus estimates, while its adjusted $151 million loss before interest, tax, depreciation and amortization was better than the street expected. Importantly, the company remains “cautiously optimistic” it can reach its goal of no more than $500 million of adjusted EBITDA loss for the full year, the report added.

Coinbase shares fell almost 8% in premarket trading to $80.74.

Bank of America notes that Coinbase had no counterparty exposure to the crypto insolvencies witnessed in the second quarter. The company also has a “history of no credit losses from financing activities, holds customer assets 1:1, and any lending activity of customer crypto is at the discretion of the customer, with 100%+ collateral required.” These rigorous risk-management practices will be a “positive long-term differentiator” for the stock, the bank said.

JPMorgan said Coinbase had endured another challenging quarter, while noting some positives.

Trading volume and revenue were down materially. Subscription revenue was also lower, but would have been much worse were it not for higher interest rates, it said in a research report Wednesday.

The company is taking steps on expense management, and in addition to the June headcount reductions, is scaling back marketing and pausing some product investments, the note said.

The bank says the company’s near-term outlook is “still grim,” noting that the exchange expects a continued decline in 3Q 2022 monthly transacting users (MTUs) and trading volumes, but says Coinbase could take more “cost actions” if crypto prices fall further.

JPMorgan is less optimistic than Bank of America about the company in the near term, saying pressure on revenue from falling crypto markets will have a negative impact on the stock price. Still, it sees positives including higher interest rates, from which the firm will generate revenue. It also sees opportunities for the exchange to grow its user base, leveraging almost $6 billion of cash. The surge in crypto prices in July, and the forthcoming Ethereum Merge are also seen as positive catalysts, it added.

The bank maintained its neutral rating on the stock and raised its price target to $64 from $61.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.

Business

Elon Musk sold $6.9B in Tesla stock in case he’s forced to buy Twitter

Published

2 years agoon

08/10/2022By

Drew Simpson

Elon Musk sold $6.9 billion of his shares in Tesla Inc., the billionaire’s biggest sale on record, saying he needed cash in case he is forced to go ahead with his aborted deal to buy Twitter Inc.

“In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock,” Musk tweeted late Tuesday after the sales were disclosed in a series of regulatory filings.

Asked by followers if he was done selling and would buy Tesla stock again if the $44 billion deal doesn’t close, Musk responded: “Yes.”

Yes.

In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock.

— Elon Musk (@elonmusk) August 10, 2022

Tesla’s chief executive officer offloaded about 7.92 million shares on Aug. 5, according to the new filings. The sale comes just four months after the world’s richest person said he had no further plans to sell Tesla shares after disposing of $8.5 billion of stock in the wake of his initial offer to buy Twitter.

Musk last month said he was terminating the agreement to buy the social network where he has more than 102 million followers and take it private, claiming the company has made “misleading representations” over the number of spam bots on the service. Twitter has since sued to force Musk to consummate the deal, and a trial in the Delaware Chancery Court has been set for October.

In May, Musk dropped plans to partially fund the purchase with a margin loan tied to his Tesla stake and increased the size of the equity component of the deal to $33.5 billion. He had previously announced that he secured $7.1 billion of equity commitments from investors including billionaire Larry Ellison, Sequoia Capital, and Binance.

“I’ll put the odds at 75% that he’s buying Twitter. I’m shocked,” said Gene Munster, a former technology analyst who’s now a managing partner at venture-capital firm Loup Ventures. “This is going to be a headwind for Tesla in the near term. In the long term, all that matters is deliveries and gross margin.”

At the weekend, Musk tweeted that if Twitter provided its method of sampling accounts to determine the number of bots and how they are confirmed to be real, “the deal should proceed on original terms.”

Good summary of the problem.

If Twitter simply provides their method of sampling 100 accounts and how they’re confirmed to be real, the deal should proceed on original terms.

However, if it turns out that their SEC filings are materially false, then it should not.

— Elon Musk (@elonmusk) August 6, 2022

Musk, 51, has now sold around $32 billion worth of stock in Tesla over the past 10 months. The disposals started in November after Musk, a prolific Twitter user, polled users of the platform on whether he should trim his stake. The purpose of the latest sales wasn’t immediately clear.

Tesla shares have risen about 35% from recent lows reached in May, though are still down about 20% this year.

With a $250.2 billion fortune, Musk is the world’s richest person, according to the Bloomberg Billionaires Index, but his wealth has fallen around $20 billion this year as Tesla shares declined.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.

Business

The rent is too d*mn high for Gen Z: Younger generations are ‘squeezed the most’ by higher rents, BofA says

Published

2 years agoon

08/09/2022By

Drew Simpson

Most of Gen Z is too young to remember the 2010 New York gubernatorial candidate Jimmy McMillan.

But over a decade later, they would probably agree with his signature issue (and catchphrase): the rent is too damn high.

This July, median rent payments were 7.4% higher than during the same period last year, according to a Bank of America report released Tuesday.

The national median price for a one-bedroom apartment has been hitting new highs nearly every month this summer. It was $1,450 for July, according to rental platform Zumper. In the country’s largest city, New York, average rent exceeded a shocking $5,000 a month for the first time ever in June.

But inflation in the rental market hasn’t hit each generation equally, and no one is getting squeezed harder by the higher monthly payments as Gen Z. Those born after 1996 have seen their median rent payment go up 16% since last July, compared to just a 3% increase for Baby Boomers, BofA internal data shows.

“Younger consumers are getting squeezed the most by higher rent inflation,” BofA wrote.

The great rent comeback

Early in the pandemic, landlords slashed rents and gave significant COVID discounts to entice tenants to stay instead of leaving urban areas. Once those deals started expiring in 2021, many landlords suddenly raised payments once again, sometimes asking for over double their pandemic value.

Young people across the board have been hit hard, and rent burdens compared to age can be seen even within a single generation. Younger millennials had their median rent payment grow 11% from last year, while the median payment for older millennials rose 7%. Gen X experienced a 5% median rent increase, according to BofA.

It’s not a surprise, then, that Gen Z feels so strapped for cash. The majority of young people, 61%, said they want to receive their wages daily instead of twice a week, a practice typically reserved for workers living paycheck to paycheck, according to a report from the Center for Generational Kinetics, which specializes in research across the generations. Rising rent inflation has even priced nearly a third of Gen Zers out of the apartment search altogether. Around 29% of them have resorted to living at home as a “long-term housing solution,” according to a June survey from personal finance company Credit Karma.

It’s no wonder—the rent really is too high.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.