Politics

NatureBox versus SnackMagic – ReadWrite

Published

3 years agoon

By

Drew Simpson

Remote snacking companies have surged during the pandemic. Our office stayed busy sending out boxes — or dropping a snack box on the porch for our “work at home” employees and sending an “invite to make a box for yourself on us.”

My assistant suggested that we get a snack package sent to our remote team so that we could all stay connected. I had not expected the response rate. We heard from every employee — with gratitude — that we (well my assistant) took the time to send a “care package.” Usually, we would just have each person pick what they wanted — but we decided to do something special and snail-mail. It was awesome.

Leading Snack Companies

Here we take a close look at two of the leading snack companies — one upstart leader, and one a 10-year veteran. We put each company through their paces to help you determine which snacks might be better for you — especially as HR Managers prepare for some portion of the workforce to be back in the office.

But, seriously — if you want to let your office employees know how much you appreciate them — dig into a snack company and send out an appreciation gift that all of your peeps will love.

SnackMagic came on the scene last year through a pivot from their pre-covid catering services company. Catering went the way of many U.S. businesses during the pandemic. The customers left and SnackMagic bravely started a new company with an online solution enabling gift givers to send a “SnackStash” to recipients who could then, in turn, redeem snacks online.

SnackMagic resells challenger brands and claims to have over 500 SKU’s to choose from. Most of their inventory is products that you would find on Amazon and some local retail stores. Recently the company raised capital and is now selling other non-food items. They purport to be “The only 100% customizable snack box company.”

NatureBox has been delivering health snacks direct-to-consumers for a decade and also has corporate clients like Google.

Pre-covid NatureBox also had a popular in-office snack program with its own branded products. During Covid, NatureBox turned to its existing direct-to-consumer capabilities to deliver customizable snack boxes with a solution called “SnackPass.” The NatureBox Company is also a 100 percent customizable snack box solution. Naturebox has a large collection of its own branded adaptogenic wellness snacks — and recently launched a new Partner Market of curated third-party brands.

With secret shoppers — and our own team at ReadWrite — we tried both of these company’s snacks. Here is what we found.

Site Experience With Snackmagic

Snackmagic had an intuitive website and the ordering process was easy. The ordering included a breadcrumb trail and a good check-out flow. The starting pricing per box was $45 dollars making an order a bit pricey (especially if you’re sending out a care package for your team). Once you place an order, the user gets an email or a link back to SnackMagic’s site to redeem their SnackStash.

The user experience on the receiver side is good with a lot of choices once the user gets to the website. Some of our people really like the variety — but many found the process a bit overwhelming to fill their carts and found it a little hard to choose so many similar products.

Site Experience With NatureBox

The site experience with NatureBox went pretty well and was efficient. We were able to order directly on the site with no problems. It was nice to see a phone number on the site if we needed assistance or didn’t understand something.

The NatureBox SnackPass started at $25 dollars which was much more approachable — again, especially when you want to be generous to quite a few people who are having a hard time adjusting in this economy.

We decided to set our budget for the minimum of $45 at NatureBox so we could see exactly how it would “stack up” to the exact SnackMagic dollar amount. It was really nice to be able to customize a message with our logo with the NatureBox Box.

The user experience for redemption was easy for our recipients as well. Once they got to the NatureBox site they also received a free membership to NatureBox and the assortment was appealing.

Slight Edge: SnackMagic

It is easier to send things out to your employees — or have your team pick and choose from a site if it’s not going to break the bank. I got a little grumpy with the price. But the SnackMagic Box seemed to have a slight edge over the NatureBox offerings.

Product and Unboxing of the SnackMagic Box:

For Snack Magic — when the product arrived, the box had a colorful sticker and it was visually exciting. The box had plenty of snacks in the delivery box, but many of them were smaller serving sizes than expected. (This made us wonder if some were samples.) Some of the snacks were terrific but in the end, only about 60% of what came in the box was consumed.

We all felt that one selling point was lacking with SnackMagic. Due to the serving sizes, it was harder to share with the family. Now maybe if Covid hadn’t been in full swing, this would not have mattered that much — but somehow — we didn’t want to share.

My assistant did a quick look-up on the products and found that a vast majority of the snacks were listed on Amazon. Not the worst thing, we buy a lot of stuff from Amazon.

Product and Unboxing of NatureBox

Naturebox arrived with a “Ya I’m here” logo on the box. Fun and equally appealing to all. The box was a bit larger than SnackMagic. What was delivered was quite good. Naturebox products had multiple servings per snack package and tasted great. The packs were all large enough that office people or family could have a taste of each item.

The sampling of many items — even if poured out to individuals — was a blast — and we ate all the products. While NatureBox offered a “Snack Guarantee” that would have allowed us to replace any of the snacks, we did not need to send back or exchange anything. Lots of variety in crunchy items and variety in the flavors.

We looked each item up and could not find any of the products on Amazon. The Tumeric Lemon cookies won the household (and the employee vote).

Edge: NatureBox

We really liked that we had not seen any of these items before and that we could share the amounts of product with others in the family. It was fun to have new snack stuff to share at home.

In-Office Snacking

When SnackMagic pivoted to remote teams during the pandemic, it appears that they burned the ships behind them on the old in-office snacking model. Today their system does not seem to be designed for in-office solutions. We could not find the use-case on their site, but they may be working on their pivot for the near future. We are wishing them the best.

NatureBox has a dedicated product for in-office snacking solutions.

NatureBox has a month-to-month solution with no contracts and most of their product is in bulk. NatureBox leverages CDC compliant no-touch containers and you can mix up your variety as often as you like.

We did not go through the order process but it appears that NatureBox picked up where they left off before COVID. We assume that their new Partner Market may also be available to corporate accounts.

Edge: Naturebox

Bottom line

SnackMagic impressed us upfront — but NatureBox delivered a better product in the end for remote teams.

It is nice to be able to have end-users customize their own snack boxes. Both Companies deliver on customization, but the user’s end experience with the product and uniqueness of what arrived gave NatureBox the upper hand.

If you need one solution for both in-office and remote teams, NatureBox looks to have a better option. At this time we found one vendor and consistency for home and office.

Image Credit: julia larson; pexels; thank you!

Brad Anderson

Editor In Chief at ReadWrite

Brad is the editor overseeing contributed content at ReadWrite.com. He previously worked as an editor at PayPal and Crunchbase. You can reach him at brad at readwrite.com.

You may like

-

Why Should a SaaS Startup Use a Knowledge Base? – ReadWrite

-

The Problems of Last Mile Delivery and 5 Ways to Improve It – ReadWrite

-

How to Identify Fake Online Agencies – ReadWrite

-

10 Business Communication Trends For 2022 – ReadWrite

-

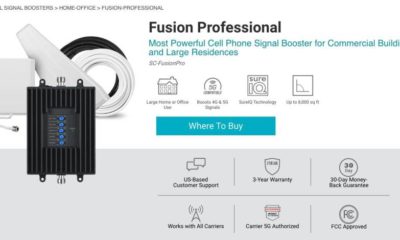

SureCall Signal Boosting System to Stay Connected – ReadWrite

-

101 Inspiring Quotes to Help You Spring Forward – ReadWrite

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.