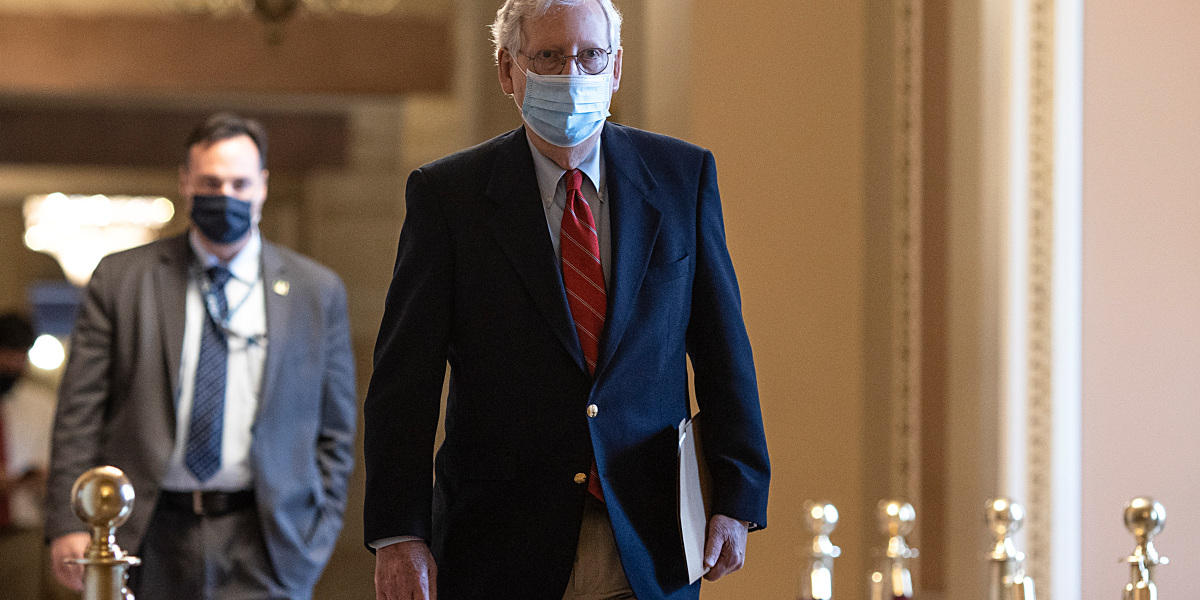

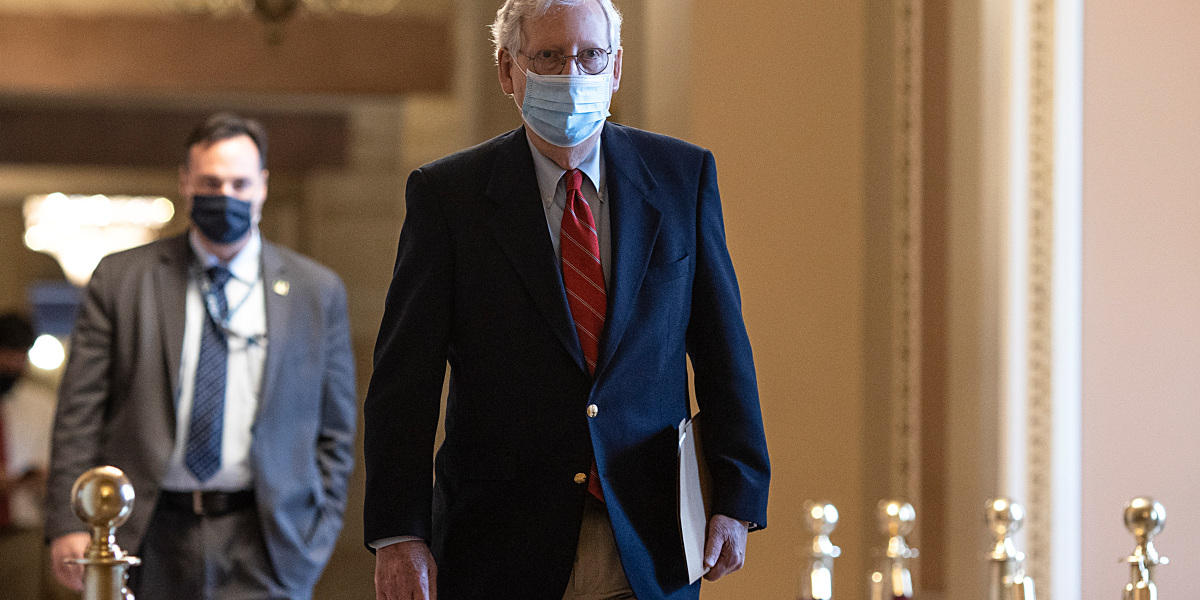

Top Capitol Hill negotiators sealed a deal Sunday on an almost $1 trillion COVID-19 economic relief package, finally delivering long-overdue help to businesses and individuals and providing money to deliver vaccines to a nation eager for them.

The agreement, announced by Senate leaders, would establish a temporary $300 per week supplemental jobless benefits and $600 direct stimulus payments to most Americans, along with a new round of subsidies for hard-hit businesses and money for schools, health care providers and renters facing eviction.

The House was expected to vote on the legislation very late Sunday or Monday and Senate action would follow. Lawmakers are eager to leave Washington and close out a tumultuous year.

A breakthrough came late Saturday in a fight over Federal Reserve emergency powers that was resolved by the Senate’s top Democrat, Chuck Schumer of New York, and conservative Republican Pat Toomey of Pennsylvania. That led to a final round of negotiations.

The final agreement is the largest spending measure yet. It combines COVID-19 relief with a $1.4 trillion government-wide funding plan and lots of other unrelated measures on taxes, health, infrastructure and education.

Passage is nearing as coronavirus cases and deaths spike and evidence piles up that the economy is struggling.

Late-breaking decisions would limit the $300 per week bonus jobless benefits — one half the supplemental federal unemployment benefit provided under the CARES Act in March — to 10 weeks instead of 16 weeks as before. The direct $600 stimulus payment to most people is also half the March payment, subject to the same income limits in which an individual’s payment begins to phase out after $75,000.

President Donald Trump is supportive, particularly of the push for providing more direct payments. “GET IT DONE,” he said in a tweet late Saturday.

It would be the first significant legislative response to the pandemic since the $1.8 trillion CARES Act passed virtually unanimously in March.

The legislation was held up by months of dysfunction, posturing and bad faith. But talks turned serious last week as lawmakers on both sides finally faced the deadline of acting before leaving Washington for Christmas.

In the meantime, with a government shutdown deadline looming at midnight Sunday, lawmakers faced the reality of needing to enact another temporary spending bill — the second in as many days — to avert a shutdown of non-essential activities by federal agencies on Monday.

Lawmakers had hoped to avoid that step, but progress slowed Saturday as Toomey pressed for the inclusion of a provision to close down the Fed’s lending facilities. Democrats and the White House said it was too broadly worded and would have tied the hands of the incoming Biden administration, but Republicans rallied to Toomey’s position.

The Fed’s emergency programs provided loans to small and mid-size businesses and bought state and local government bonds. Those bond purchases made it easier for those governments to borrow, at a time when their finances were under pressure from job losses and health costs stemming from the pandemic.

Treasury Secretary Steven Mnuchin said last month that those programs, along with two that purchased corporate bonds, would close at the end of the year, prompting an initial objection by the Fed. Under the Dodd-Frank financial overhaul law passed after the Great Recession, the Fed can only set up emergency programs with the support of the treasury secretary.

Toomey said the emergency powers were designed to stabilize capital markets at the height of the pandemic this spring and were expiring at the end of the month anyway. Democrats said that Toomey was trying to limit the Fed’s ability to boost the economy, just as President-elect Joe Biden prepared to take office.

The agreement on virus aid would deliver more than $300 billion in aid to businesses as well as the extra $300-per-week for the jobless and renewal of state benefits that would otherwise expire right after Christmas. It included $600 direct payments to individuals; vaccine distribution funds; and money for renters, schools, the Postal Service and people needing food aid.

The governmentwide appropriations bill would fund agencies through next September. That measure was likely to provide a last $1.4 billion installment for Trump’s U.S.-Mexico border wall as a condition of winning his signature.

More must-read finance coverage from Fortune:

- Upstart CEO talks major IPO “pop,” A.I. racial bias, and Google

- Biden wants to change how credit scores work in America

- Term Sheet readers predict which markets will boom in 2021

- Why investors jumped on board the SPAC “gravy train”

- Citron calls this the “most ridiculous” IPO of 2020