Politics

Cryptocurrency Myths and Facts Every Investor Should Know

Published

2 years agoon

By

Drew Simpson

There is a lot of talk about cryptocurrencies these days, and it seems everyone has an opinion on it. Here are some cryptocurrency myths and facts every investor should know.

Some will praise cryptocurrency as being a new alternative to traditional currency. Many will claim that it is one of the best investments you could ever make. On the other hand, some people believe that cryptocurrency isn’t here to stay and that it will implode and lose all value once the bubble bursts.

What are the facts about cryptocurrency, and what are the myths? Should you really invest in cryptocurrency, or should you stay away from it? Keep reading to learn all this and more as we go over eight cryptocurrency myths and facts that you should know before investing in it.

Myth – Bitcoin and The Blockchain are Interchangeable

Fact – Each Cryptocurrency Has Its Own Blockchain (For the Most Part)

Many people don’t fully understand what a blockchain is, which has led to a lot of myths surrounding its nature. A blockchain is like a virtual ledger that cryptocurrencies are built and traded on. Though there are exceptions, each cryptocurrency has its own blockchain and can only be traded on that blockchain. This means that you wouldn’t be able to go to the Ethereum blockchain and trade Bitcoin on it or vice versa.

Also, keep in mind that different blockchains function differently. For example, the blockchain is created to make Bitcoin work like digital cash in Bitcoin’s case. On the other hand, Ethereum was created to allow developers to build peer-to-peer apps that don’t need an intermediary to work in addition to the blockchain itself.

You should take away from all of this because there are multiple cryptocurrencies; they each have their own blockchain in most cases and function as separate entities. The blockchain is not the cryptocurrency itself, but rather a platform that allows you to use the cryptocurrency.

Myth – Cryptocurrencies Aren’t Regulated

Fact – Cryptocurrencies Are Becoming More Regulated Each Year

When cryptocurrencies first appeared, it really was like the wild west since no laws or regulations had been created to regulate them. As a result, some people were wary because they thought governments would simply crackdown and ban cryptocurrencies rather than regulate them. However, as time has passed, things have started to change, and governments have begun looking at ways to regulate cryptocurrency rather than ban it outright.

One of the reasons for this approach is that huge businesses like Amazon, Dell, and Twitch have started to accept cryptocurrencies as a payment option. Since these companies have a lot of influence across many nations, world governments are more open to working with cryptocurrencies rather than against them.

Myth – Cryptocurrencies are Illegal in Areas Where They’re Not Regulated

Fact – Not Being Regulated Doesn’t Necessarily Make Cryptocurrency Illegal

Just because something is unregulated doesn’t make it illegal. For example, you and your friends could invent a form of currency that you use just between yourselves. It could be anything really, and it wouldn’t be illegal just because it isn’t regulated. Thanks, basically how it is with cryptocurrency.

An excellent example of this is the situation in South Africa. The South African Reserve Bank is working on drafting laws and regulations for cryptocurrencies, but currently, cryptocurrency is not considered legal tender. But, of course, it doesn’t make them illegal either; it just means that SARB doesn’t back cryptocurrencies.

The main thing to remember is that if you have any questions about whether cryptocurrencies are legal or regulated in your area, there is plenty of information to clear things up for you. Just make sure you get your info from a legit source, as you would with anything related to legal issues.

Myth – The Blockchain is Only Useful for Cryptocurrencies

Fact – The Blockchain has Many Uses

Once again, people tend to misunderstand the true nature of the blockchain. It isn’t just a wallet for cryptocurrencies online; it’s an entire platform that can provide multiple functions. In addition, people are coming up with new innovations for the blockchain that give it additional functionality.

One good example of how the blockchain can do more than store and trade cryptocurrency is the fact that it can also host contracts between two or more parties. This can be a big help in various cases, such as storing the contract between a loan company, and the beneficiary. It can even make the loan payments automatic if so desired.

Myth – Cryptocurrency is Used For Criminal Purposes

Fact – All Currencies are Used for Criminal Purposes, Crypto is No Different

Some people are under the impression that cryptocurrencies were created to conduct criminal business and fund criminal enterprises. However, this is not the case. A report from Chainalysis indicates that around 1% of crypto is used for illegal activity, a decrease from previous years.

Cryptocurrencies can and will be used for criminal purposes, but the same can be said of all currencies. The fact that crypto has only 1% used for illegal activity is pretty impressive, considering how traditional currencies are used.

Myth – Cryptocurrency Makes You Anonymous

Fact – Cryptocurrency Can Make Tracing Your Identity Much Harder, But Not Impossible

One of the reasons people associate cryptocurrency with criminal activities is that they think using crypto makes you anonymous. The truth is that it doesn’t, not entirely anyway. While cryptocurrency can make it incredibly difficult to trace transactions and discover a person’s identity, there are ways to do it since all transactions are recorded on the blockchain.

If you’re concerned with privacy, you should be pleased to know that cryptocurrency is one of the most secure payment methods globally. This lets you make transactions without fear of hackers or other nefarious forces getting your information and discovering your identity.

However, it should be noted that an exceptionally skilled hacker or government agency can still get into the information on the blockchain and discover a person’s identity. Interestingly enough, this is rarely done by hacking the blockchain directly, but through more indirect methods that target a person’s account, such as password phishing.

This means that protecting one’s identity while using cryptocurrency comes primarily down to following basic Internet security procedures like choosing a unique password, being careful what networks you access while using cryptocurrency, and not clicking on suspicious links in emails.

Myth – Cryptocurrency Has No True Value Because a Commodity doesn’t back it

Fact – Cryptocurrency Doesn’t Need to Be Backed by a Commodity to Have Value

This is one of the most persistent myths about cryptocurrency, but the value is subjective by its very nature, and this is especially true when it comes to currency. This has led some to claim that crypto doesn’t have an intrinsic value because it isn’t backed by a commodity such as silver or gold as many fiat currencies supposedly are. However, this fails to account for the fact that these days, fiat currencies aren’t backed by commodities either, and the commodities themselves possess no intrinsic objective value.

The value of cryptocurrency comes from the value that the buyers and sellers give it. That said, it is also subject to economic forces that influence the value as well, such as the fact that the more cryptocurrency there is, the lower its value will become. Even so, cryptocurrencies such as Bitcoin are not infinite, making them a more stable form of currency than a fiat currency in which more can always be created.

Myth – The Cryptocurrency Bubble is Going to Burst Soon

Fact – Cryptocurrency Has Steadily Gained in Value Over the Past Decade

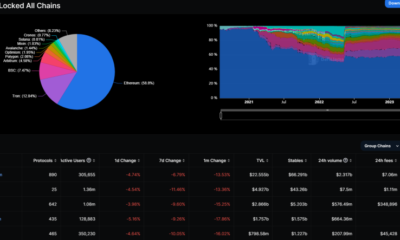

The first cryptocurrencies were seen back in 2010, and since then, most have steadily gained in value, with Bitcoin being a good example. Yes, there have been peaks and valleys, but any currency can say the same. Will the cryptocurrency bubble burst soon? Recent findings seem to indicate that it is unlikely.

Something that needs to be taken into account when discussing the supposed cryptocurrency bubble is that it has recently become the world’s 5th most circulated currency. In fact, between 2020 and 2021, crypto experienced an average increase in value of 195%, which is pretty astounding.

Myth – Cryptocurrencies are for criminals, and criminals are fickle

Fact – That’s not true

Just because some people break laws with cryptocurrencies, it doesn’t mean everyone who uses it is the wrong person to fund organized crime. We all use cash, paychecks, and credit cards. Criminals use those currency systems, too; the fact that criminals use something shouldn’t condemn that item as bad.

Myth- Cryptocurrencies are not legal tender

Fact – This is not entirely true

It might not be legal, but cryptocurrency exchange is legal, and regulations vary from state to state and are dependent on the transaction. Cryptocurrency regulations state that it is a legal tender in such cases, where it is accepted. In addition, blockchain systems can manage and increase government transparency, as many governmental organizations adopt blockchain auditing as a public service.

Myth – Cryptocurrency is hackable

Fact – Unlike banking apps and fitness trackers, blockchain is highly secure

As with regular cryptocurrencies, the miners of the blockchain system are put in a confidential mode where they offer their abilities to solve some test transactions in compromising situations.

Myth – Only rich people would use cryptocurrencies

Fact: People who earn lots of money think differently from the poor people who face financial problems

Still, cryptocurrencies received a thousand+ businesses’ acceptance and are used by those who may not have much money. Cryptocurrencies are used in everyday purchases and non-financial transactions. If a dollar is too much for some, bitcoin is enough for many others. More businesses accepting Cryptocurrencies is not a social issue since transaction fees for people who don’t use cash are zero or minimal.

Myth – Cryptocurrency is bad for planning

Fact – Many businesses use programmed software dealing with business calculations, auditing, and accounting

Cryptocurrencies and the blockchain technology that keeps the transactions assured through cryptography and transparency don’t hinder net business businesses, logistic business traders, or financial trades.

Myth – Cryptocurrencies can never be used in a business

Fact – Blockchain technology creates a great platform to conduct transactions and cash flow in businesses

It has immense features to handle cash flow; as with cryptocurrencies, there isn’t any need for a third party to manage transaction codes. Cryptocurrencies make business management more effortless.

Myth – The cryptocurrency capacity is unlimited

Fact – Cryptocurrencies like Bitcoin are mined and finite

When the blockchain space has reached its full capacity, attaining more power is difficult since processing power takes time measured in hours and not days, weeks, or even years.

Myth – Cryptocurrencies are not real donations but purchases; they are based on an artificial medium that’s derivatives at best

Fact – Bitcoin is not ‘an artificial medium

It’s an ‘electronic cash address where every person gets their private keys (wallets). Money generated and earned purchases by handling cryptocurrency brings value to the currency and has real worth. Without buying and selling, cryptocurrencies melt away into oblivion like Bitcoin Cash.

Is Crypto Right For You?

If you’re looking for a way to make digital payment online easier, then there is no reason not to hop aboard the cryptocurrency train. Once you understand how it works, it can make online payments fast, easy, and convenient. Many people use crypto just for a fact because it’s highly secure and safe to use.

On the other hand, if you want to be a serious cryptocurrency investor, you need to understand what crypto is and the economic forces behind it. While cryptocurrency is a legit investment, there is a bit more to it than just purchasing some and hoping it rises in value as a stock would.

If you want to invest in crypto, now is a great time. Just make sure you do your research first, and make an informed decision. Do this, and you won’t regret it.

Image Credit; Pexels; Thank you!

Emily Lamp

Emily Lamp is a professional writer, working closely with many aspiring thinkers and entrepreneurs from many industries including Dan Hollings The Plan. She is also interested in financial investment, business growth and marketing.

You may like

-

New Cryptocurrency Launches to Invest in for August 2023

-

Cryptocurrency and Blockchain Security: Challenges and Solutions

-

Crypto Trading and Its Impact: Understanding the World of Cryptocurrency

-

Ethereum moved to proof of stake. Why can’t Bitcoin?

-

Busting three myths about materials and renewable energy

-

The Download: CRISPR crops, and busting renewables myths

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

8 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

8 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

8 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.