Politics

How Investors Make Millions Amid Volatility

Published

2 years agoon

By

Drew Simpson

It’s been a crazy year in the markets, huh? But what if I told you that all this craziness is actually creating the money-making opportunity of the century?

You’d be skeptical. And that’s fine. Just don’t disregard me because I have a ton of data to prove that claim. Today, we sit on the cusp of arguably the biggest investment opportunity in the stock market… ever.

Yes, I’m aware of all the problems the world is facing today. Decades-high inflation. A U.S. Federal Reserve embarking on the most aggressive rate-hiking cycle in over 40 years. A war in Europe for the first time since World War II. The highest gas prices and grocery prices in decades. The biggest stock market crash since 2008.

Talk about unusual, volatile, scary.

Against that backdrop, I wouldn’t blame you for wanting to run for the hills and take cover from the storm. But the great Warren Buffett once said that it is often best to be greedy when others are fearful.

Everyone’s fearful right now.

The American Association of Individual Investors weekly survey has found that for two weeks in a row, the percentage of bearish investors in America has outnumbered the percentage of bullish investors by more than 40%. That’s an unusually high number which marks “peak fear.” Indeed, the net bull ratio has been this low only once before, in early March 2009 – the exact same week stocks bottomed after the 2008 financial crisis!

Let that sink in for a moment…

There’s nothing but fear out there. Buffett would tell us to get greedy here. But should we heed those words of advice?

Absolutely.

Fear Can Be a Good Thing?

Over the past several months, my team and I have been studying the intricacies of stock market crashes throughout the history of modern capitalism – and we discovered something amazing.

Specifically, we’ve discovered a rare stock market phenomenon that occurs about once every 10 years. And it consistently represents the best buying opportunities in U.S. stock market history.

More than that, we figured out how to quantitatively identify this phenomenon. Yes, we have engineered a way to take advantage of it for massive profits.

Well, folks, guess what’s happening right now?

This ultra-rare stock market phenomenon has emerged. And our models are flashing bright “Buy” signals.

I know. That may sound pretty counterintuitive, considering what’s going on in the market right now.

But I’m staking my career on this claim – because it’s really not an opinion. It’s a fact. Backed by data, history, statistics and mathematics. Backed by the biggest market phenomenon in history.

So, I repeat: We stand on the cusp of an opportunity of a lifetime.

By now, you’re probably asking: OK, Luke, you have my attention…but where’s the proof?

Glad you asked because I have lots of that. Let’s take a deep look.

Stock Prices Follow Fundamentals

To understand the unique phenomenon my team and I have identified, we need to first understand the behavior patterns of stocks.

In the short term, stocks are driven by myriad factors. These include geopolitics, interest rate, inflation, elections, recession fears, and so on.

Big picture, however, stocks are driven by one thing and one thing only: fundamentals.

That is, at the end of the day, revenues and earnings drive stock prices. If a company’s revenues and earnings trend upward over time, then the company’s stock price will follow suit. Conversely, if a company’s revenues and earnings trend downward over time, then the company’s stock price will drop.

That may sound like an oversimplification. But, honestly, it’s not.

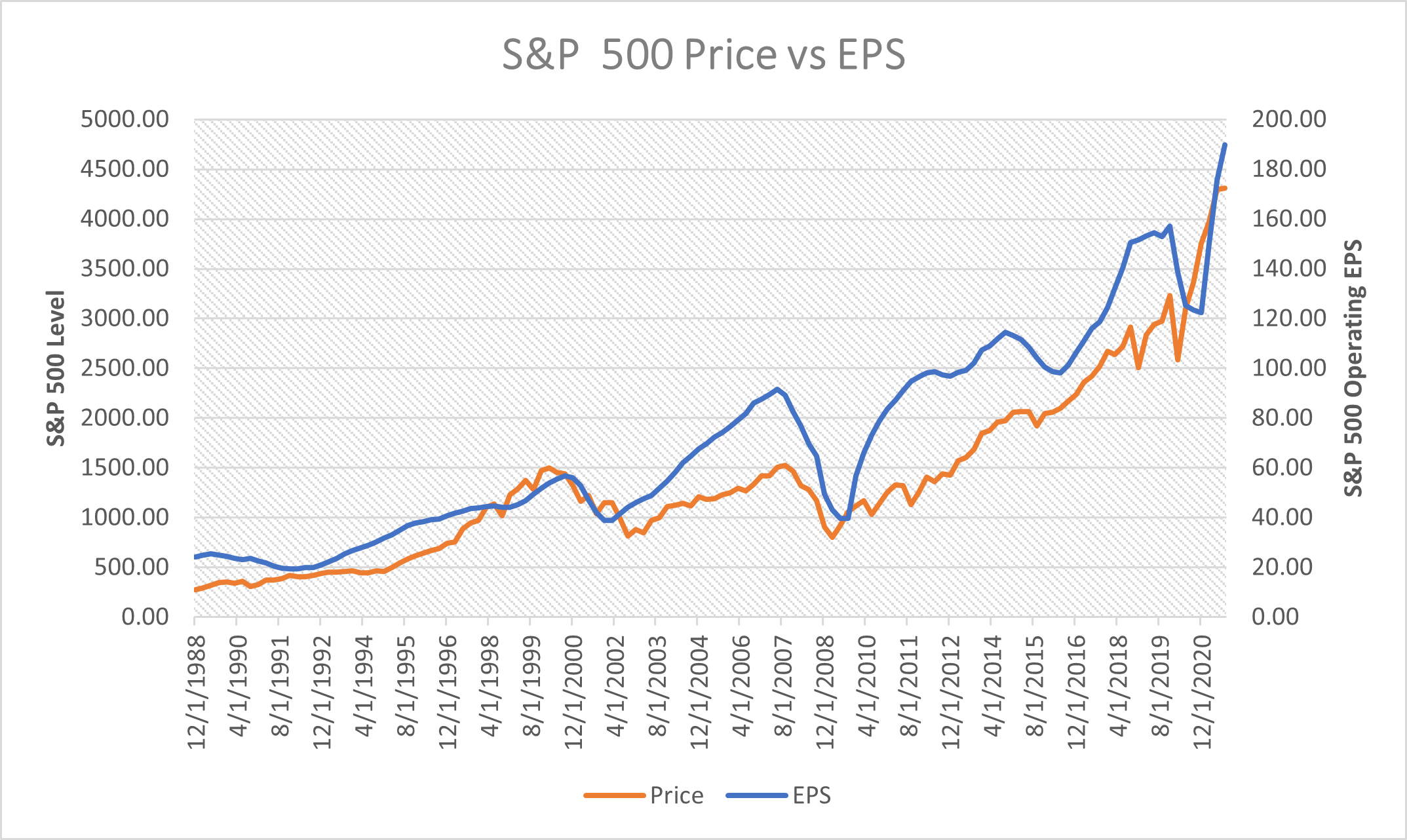

Just look at the following chart. It graphs the earnings per share of the S&P 500 (the blue line) alongside the price of the S&P 500 (the orange line) from 1988 to 2022.

As you can see, the blue line (earnings per share) lines up almost perfectly with the orange line (price). The two could not be more strongly correlated. Indeed, the mathematical correlation between the two is 0.93. That’s incredibly strong. A perfect correlation is 1. A perfect anti-correlation is -1.

Therefore, the historical correlation between earnings and stock prices is about as perfectly correlated as anything gets in the real world.

In other words, you can forget the Fed. You can forget inflation and geopolitics. You can forget trade wars, recessions, depressions, and financial crises.

We’ve seen all of that over the past 35 years – and yet, through it all, the correlation between earnings and stock prices never broke or even faltered at all.

At the end of the day, earnings drive stock prices. History is crystal clear on that. In fact, history is as clear on that as it is on anything, mathematically speaking.

The phenomenon my team and I have identified has to do with this correlation. In fact, it has to do with a “break” in this correlation – a break that historically only arises when recession fears are peaking and has produced the greatest stock market buying opportunities in history.

Great Divergence Creates Great Opportunities

Every once in a while – specifically, about once a decade – earnings and revenues temporarily stop driving stock prices.

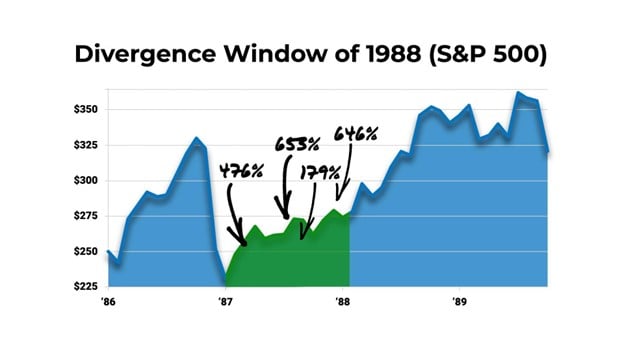

We call this anomaly a “divergence.”

During these divergences, companies continue to see their revenues and earnings rise. But due to some macroeconomic fears, their stock prices will temporarily collapse. The result is that a company’s stock price diverges from its fundamental growth trend.

Every time these rare divergences emerge, they turn into generational buying opportunities. Stock prices “snap back” to fundamental growth trends, and investors who bought the dip see their returns rocket.

This has happened time and time again, like clockwork, throughout the market’s history.

It happened in the late 1980s during the Savings & Loans crisis. High-quality growth companies – like Microsoft (MSFT) – saw their stock prices collapse while revenues and earnings kept rising. Investors who capitalized on this divergence doubled their money in a year and scored a jaw-dropping ~40,000% returns (on average) in the long run.

And it happened in the early 2000s after the dot-com crash. High-quality growth companies – like Amazon (AMZN) – saw their stock prices plunge. But their revenues and earnings kept rising. Investors who capitalized on this divergence more than doubled their money in a year and scored more than 20,000% returns in the long run.

It happened again in 2008 during the Great Financial Crisis. High-quality growth companies – like Salesforce (CRM) – saw their stock prices collapse. But their revenues and earnings kept rising. Investors who capitalized on this divergence almost tripled their money in a year and hit 10X returns in just five years.

This is the most profitable repeating pattern in stock market history. And it’s happening again right now for the first time in 14 years.

The Final Word on Divergence

My team and I understand that market volatility always creates market opportunity.

So, amid the market’s wild gyrations of 2022, we’ve made it our top priority to research market volatility and develop a stock-picking strategy to make tons of money during choppy markets.

That led us to making the biggest discovery in InvestorPlace history: the existence of rare divergence windows.

These divergence windows only appear about once a decade, amid peak market volatility. They open for very brief moments in time and only for certain stocks. But if you capitalize on them – by buying the right stocks at exactly the right moment – you can make a lot of money while everyone else is struggling to survive in a choppy market.

More than that, these divergence windows give you a real shot at turning $10,000 investments into multi-million-dollar paydays.

The more we researched these divergence windows, the more excited we became.

But here’s the most important part: Because these opportunities emerge out of fear in the markets – and because we’ve reached peak fear – my team and I have concluded that this ultra-rare investment opportunity is rapidly closing shut.

This is your final chance to capitalize on what could be the biggest investment opportunity of your life.

That’s why we’re calling this month the “Zero Hour.” It’s your final opportunity to capitalize on the 2022 divergence.

To help you do that, we’ve put together an emergency broadcast – unsurprisingly dubbed the Zero Hour – to walk you through this enormous investment opportunity. We will go LIVE with that broadcast this Thursday afternoon, at 4 p.m. EST.

In it, I’ll unveil my No. 1 “late-stage” divergence stock to buy right now – for free. This is a stock that could easily soar hundreds of percent over the next year alone!

More than that, I’ll even give viewers the chance to access a brand-new, never-before-seen portfolio of divergence stocks set to soar over the next year.

This is certainly a broadcast you don’t want to miss.

Published First on InvestorPlace. Read Here.

Inner Image Credit: Provided by the Author; Thank you!

Featured Image Credit: Photo by Kampus Production; Pexels; Thank you!

You may like

-

Vertex will pay tens of millions to license a controversial CRISPR patent

-

China wants to win the gene therapy race—and it’ll spend millions

-

A stealth effort to bury wood for carbon removal has just raised millions

-

A new app aims to help the millions of people living with long covid

-

Key Elements to Include in Your Business Plan if You Want to Attract Investors

-

5 Types of Loans to Help Investors Grow Their CRE Portfolios

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.