Politics

These Five Types of Robots Support Warehouse Workflows

Published

2 years agoon

By

Drew Simpson

Industrial professionals know that various types of warehouse robots help get work done in giant facilities. Many customers never know what role the machines play in ensuring they receive items on time and in good condition.

Individuals considering using robots in industrial automation should spend adequate time learning about the capabilities and limitations of these high-tech machines. For example, some types of robots help carry products to different locations in a facility, while others assist with picking and packing items.

People worry robots will take over their jobs. Such anxieties are at least partly justified, especially for individuals in low-skilled roles. However, in the best cases, robotics allow humans to participate more-enjoyable activities that utilize their creativity and brainpower. Robots excel in repetitive tasks but don’t have the depth of experience most humans naturally acquire throughout their careers and lifetimes. Some experts argue that robots must ideally support people instead of replacing them.

Regardless of how individuals feel about these machines, the fact remains that robots in industrial automation are here to stay. Here are the types of warehouse robots that typically provide the most value to the decision-makers who invest in them.

1. Automated Guided Vehicles

Automated guided vehicles (AGVs) are reliable options for transporting goods from one area to another. It’s easy to see how convenient they are in huge facilities like warehouses. AGVs move in dedicated areas by utilizing wires or markings on the floor. Most models have onboard cameras and sensors to help with this task, ensuring they go to the right places while avoiding obstacles.

Engineers working in the warehouse can also program the AGVs to follow predetermined routes at certain times. These types of robots are particularly handy when decision-makers prioritize improving workflows.

In one instance, a manufacturer added AGVs to a generator production line. This improvement reportedly led to a tenfold production increase. Additionally, it boosted the quality of items sent to customers. Company leaders initially considered installing a conveyor belt with six month lead time. However, they ended up going with AGVs since they had a lead time of only two to four months.

Many warehouse leaders have also pursued AGVs to relieve labor-shortage pressures. Such usage of robots in industrial automation frees humans up to do more value-added tasks while the machines handle duties like moving and storing pallets.

2. Types of Warehouse Robots That Can Pinch and Grip Items

People that invest in warehouse robots usually look for highly functional machines. That’s why many models have articulated arms that let them move similarly to human limbs. However, such robots have limited usefulness unless they can also pick up items without dropping them.

Fortunately, engineers have built feasible solutions to accommodate this requirement. A standalone layer-picking robot can lift up to 825 pounds per layer. These machines also tolerate a large temperature range, making them suitable for taking items from freezers or working in spaces without air conditioning.

Experts say that piece-picking robots have massively improved in just a few years. They can handle a wider variety of items than they once could, even if the products are oddly shaped. In 2021, researchers developed a miniature, multifunctional soft gripper inspired by human hands. Lab tests showed their creation could pick up items ranging from snail eggs to metal washers and polystyrene balls without harming them. Such versatility is vital in a warehouse that could have a tremendous assortment of items.

Amazon engineers are also working on a pinch-grasping robot. Tests showed a prototype achieved a tenfold reduction in product damage due to its gentle but secure grip. Many types of warehouse robots used within the e-commerce company also work with machine learning algorithms. Machines can identify certain items within a cluttered environment and determine the best ways to pick them up safely and effectively.

Most grasping robots used in today’s warehouses utilize suction cups. They work reasonably well, but complications can result. A machine’s suction seal can fail, particularly if a robotic arm moves especially quickly or changes its angle. Plus, compensating for the problem by increasing the suction strength could make product packaging tear. The work done by Amazon’s team could change the future of robots in industrial automation.

3. Autonomous Mobile Robots

Autonomous mobile robots (AMRs) are part of a larger category of robotic technology called cobots. These machines have various safety features that allow them to work around people without staying behind cages or other barriers. Some cobots stop people from suffering long-term arm damage from repetitive and physically taxing tasks.

However, AMRs are usually most valuable for saving people from walking so far during their warehouse shifts. They work similarly to AGVs, but autonomous mobile robots don’t need any guides on the floor to influence their travel paths. Instead, they have advanced mapping technology that allows them to learn the specifics of a space, then navigate around it safely. Even better, these robots can handle spontaneous environmental changes, such as a person suddenly walking in front of them.

Some companies use these types of robots to handle various needs in a warehouse. C-StoreMaster, a convenience store distributor, shows a strong example of the possibilities. That business has a 135,000-square-foot distribution center in Alabama. AMRs take center stage there in helping operations run smoothly.

The business uses different kinds to meet various needs. One handles pallets, another transports shelving, and a third places and retrieves totes from shelves up to 15 feet high. This exploration into the various types of warehouse robots came from leaders’ desire to create the best possible work environment for their team members. That meant keeping the work and site comfortable, air-conditioned, and ergonomically friendly.

The robotic workflow means people only have to touch goods three times. The first occurs when products are unloaded from incoming trucks, and the next happens during order picking. Finally, team members handle the goods during order consolidation before shipping. Otherwise, the AMRs do about 80% of the work.

4. Types of Robots That Predict Human Movement

Warehouse robots are increasingly advanced and safe. However, things can still go wrong. One example occurred when three robots collided with each other and started a fire in the London facility of a grocery delivery brand. The incident required 15 fire engines and approximately 100 firefighters to contain.

Most warehouse workers know injury risk comes with their roles. However, they tend to feel safer if they know robots have numerous features to stop them from accidentally hurting humans. All cobots include design choices such as soft components and moving parts that slow or stop when people get too close. Those are essential, but researchers are still pushing the boundaries to see what else is possible.

Work at KTH Royal Institute of Technology involves developing an artificial intelligence-driven system for robots that can respond to contextual clues. It can identify individual workers and their skeleton models. A robot then relies on this information to predict what an employee will do next. The machine would not necessarily need to disrupt the workflow by slowing down or stopping if people get in the way because it could proactively adjust its movements instead.

However, these types of warehouse robots are also commercially available from at least one company. Robust AI’s Carter robot looks like a dolly but has a motorized base, touch screen, and periscope with several cameras. It uses cameras to scan its surroundings. However, the robot can also identify workers and try to infer what they’re doing from their poses.

5. Robots Available Through Subscription-Based Plans

Many decision-makers are on board with the prospect of deploying numerous types of warehouse robots in their facilities. However, they balk at the associated upfront costs. That hesitation is particularly likely when business leaders have no direct experience using robots.

Fortunately, providers that offer robots-as-a-service (RaaS) subscription plans can alleviate that anxiety. The specifics vary by company. Generally, though, customers pay per-usage rates for robots obtained through rental agreements. The client prices also often include essentials like installation costs, repairs, maintenance, and upgrades. When people can calculate what they’re likely to pay month to month and eliminate surprise expenses, they’re much more likely to be open to using robots in industrial automation efforts.

Locus Robotics pioneered this concept back in 2014. Thus, it’s not a new option but one that’s quickly gaining momentum. That’s especially true as more people become familiar with warehouse robots and begin thinking strategically about how they might use them. The company’s customers reportedly see full returns on investments within six to eight months of installation.

RaaS contracts typically run from nine months to four years. That means it’s easy for customers to decide how much of a commitment they want to make before signing a document and sealing the deal.

When decision-makers already feel confident about the payoffs of using warehouse robots, RaaS may not be the best option. However, when doubts remain, paying for the technology via a subscription plan could let people test the waters.

Robots in Industrial Automation Improve Warehouse Operations

The five robot types discussed here are among those that appear in warehouses most frequently. However, other options exist, too. People are most likely to get the best results from their efforts to use robots if they think carefully about current shortcomings and how high-tech machines could target and improve them.

After they have those areas of focus, they’ll be in an excellent position to research the options, evaluate their budgets, and take other practical steps to turn their plans into realities.

Warehouse robots won’t solve every problem, but these examples show they can help company leaders make meaningful headway in overcoming obstacles and streamlining processes.

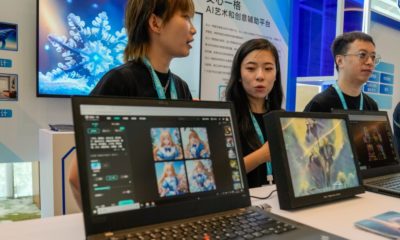

Oh, and warehouse robots don’t look as scary as this great robot pic!

Featured Image Credit: Ichad Windhiagiri; Pexels; Thank you!

Emily Newton

Emily Newton is a technical and industrial journalist. She regularly covers stories about how technology is changing the industrial sector.

You may like

-

These robots know when to ask for help

-

The Download: inside the first CRISPR treatment, and smarter robots

-

Chinese AI chatbots want to be your emotional support

-

Why is it so hard to create new types of pain relievers?

-

Underwater robots to revolutionize deep sea mining

-

What is Network Security?, Definitions, Types, Tools & Attacks

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.