Politics

Play2Earn is Dead

Published

2 years agoon

By

Drew Simpson

And we’re just propping up its corpse…

It’s time for the Web3 gaming industry to acknowledge some cold truths. A thousand projects have risen — some meteorically — and nearly all of them have crashed, hard. The explanation as to the “why” is simple, but ugly.

The concept of Play-2-Earn is a fantastic one. Earn money for playing video games! Naturally, the model is more complex than that — money doesn’t spawn from thin air! The value must come from somewhere. Unfortunately, the value that P2E gaming offers, with little exception (shout out to Splinterlands, Gods Unchained, and I’m sure at least a couple others), is rooted in asset speculation. “Oh, I have no use for this $2000 piece of virtual land. I’m just betting that someone else is willing to pay $10,000 for it.”

Indeed, there have been winners in every ecosystem. Unfortunately, Web3 games often come out to near-zero-sum — there must be winners and losers. In the worst cases, the only winners are the developers that sold the project. All of the users become losers, having surrendered precious capital for assets left worthless. I’m not afraid to be unyieldingly transparent — my own project, Draco Dice, started out this way (though there is a happy ending towards the end of the article). Consumers believed that there was an exit strategy to be executed, allowing them to hoard many thousands of digital dice so that when interest grew in the assets, they would be holding mounds of assets for which the demand, and thus value, had spiked. Though I personally strived to strike down the illusion that my NFTs existed in order to supply everyone with profit, the illusion held strong.

In the best-case scenario, the “winners” in a Web3 ecosystem are the ones who knew better. They knew the money would run out, that the user growth would grind to a halt, and that everyone still holding would be holding a useless bag. The smart ones made their exit early. On this point, too, I’ve been humbled — naively believing that assets I’ve held worth tens of thousands in USD would increase to even greater heights by some miracle of increasing user engagement.

Having thoroughly destroyed my own financial ethos for you here, I must now justify my confidence in the winners of the future.

Regardless of how cringey the term has become, I am undeniably, unabashedly a “gamer.” That is a person with a passion for games. The problem is that the gaming industry outside of Web3 has been gradually eroding consumer agency. If you’re trying to succeed with Web3 gaming, you should already know this — but here’s a quick history lesson to catch you up.

How We Got Here

First, gamers owned physical media. Compact Discs and game cartridges. Then, Steam and other enormous platforms took over with digital distribution. Suddenly, the majority of games were no longer physically manufactured and could only be supplied digitally — but the majority of digital games are not owned. Instead, the consumer has purchased a license to access the software. This license can, of course, be revoked at any time and for practically any reason. Now, with Games as a Service (GaaS) becoming an industry standard, consumers have even fewer rights! All of the work you put into an online experience can disappear as soon as the developers decide to shut down the servers.

In other words, gamers own nothing but their hardware (and even that’s arguable due to EULAs and ToS supplied by OS and console producers).

I am deep, deep in the gaming hole and I’m never coming out — my skin has paled, and my eyes have grown adjusted to the harsh blue light of the screens. Thus, it’s obvious that the potential for the increased agency for gamers offered by Non-Fungible Tokens would be phenomenal. Think about it — we could truly own the games themselves, again. We could truly own assets that we bought or earned in a game and even take them outside of the game to extract further utility. We could sell them with the support of developers instead of arranging illicit transactions through black market websites (that I’m not ashamed to say I’ve used — we don’t have a choice). And we could resell the games themselves if we decide we’re done with them.

If you’re the kind of person I intended to read this article and you share my love of games, then this vision for the future should excite and inspire you.

If you contrast it with the reality of what Play-2-Earn has done for us, though, something looks terribly, terribly off.

Fun-Filled Reality Check

The first lesson that the P2E industry should have learned is that “the game should be fun first and offer revenue second.” That lesson has yet to be thoroughly disseminated. Button-clicking token manipulation tools have ruled Web3 gaming outside of the aforementioned exceptions, and even then, “fun” continues to be an afterthought in the majority of Web3 games designed. Nobody’s been playing this stuff because they’re having a good time with the experience itself. Everyone’s after those sweet, sweet tokens. It’s all rocket emojis and calls to HODL, just like anywhere else in crypto.

This isn’t gaming!

The idea of making a living off of video games does not exist at this time — anywhere. It’s a lie and a scam. Survivorship bias be damned – of course someone is going to make off with a profit. Acknowledging this fact was transformative for me, as I realized that there is no way to sell Play-2-Earn to actual gamers.

Believe me — gamers can smell bullshit, and due to the bad rap that Web3 has been given with endless scams and pump-and-dumps, P2E reeks to them. Rightly so.

You and me — we see the hard benefits that gamers can receive for engaging in a Web3 ecosystem — but ultimately, Web3 gaming can’t be about Web3. There is no Play-2-Earn where we’re going — but we can still offer agency and the revenue. We just need to stop selling games like they’re there because you can make money. STOP IT! In order to disrupt the gaming market, this is what must be done.

This is a gold mine, right here. Build great games uncompromised by Web3, and offer beneficial Web3 utility on top of great gameplay.

I promised a happy ending earlier. This is what myself and my team have been building towards. Yes, we’re selling NFTs, but they don’t get the spotlight. They’re not the stars. The only kind of game that can become sustainable is one that players want to repeatedly engage with — because they enjoy it. That’s why I personally took an L on the short-term outcome of an otherwise highly-successful Draco Dice launch — because it’s not important. What is important is the benefits that NFTs can convey to players who are playing to play.

How to Save Web3 Gaming

For example, when I launched Draco Dice, it was in order to create a standard for gaming assets that have utility in more than one game. This is coming to fruition within mere months — we’ve simultaneously been developing Draco Dice: Skirmish and Draco Dicesweeper alongside each other. Both can be played with the same Draco Dice NFTs — offering real, undeniable utility that’s never before existed in the colossal world of video games. With that on the table, what’s next?

simultaneously been developing Draco Dice: Skirmish and Draco Dicesweeper alongside each other. Both can be played with the same Draco Dice NFTs — offering real, undeniable utility that’s never before existed in the colossal world of video games. With that on the table, what’s next?

Web3 needs to approach gamers where they are. Gamers do not care about wallets, tokens, exchanges, or any of the financial nerd stuff that we wrestle with to make profits. Gamers care about the game. I am strictly not suggesting that we obfuscate that we are putting Web3 technology to work — however, I am suggesting that we use language that gamers are used to. Gamers understand XP levels, battle passes, currencies, and even markets — but it’s on us to streamline the experience of interacting with Web3 to break down what would otherwise be considered barriers to entry — such as requiring the manual creation of a wallet on this — or that chain beyond the username/password/2FA structure to which gamers are accustomed.

Lastly, speculation must be leashed or eliminated as much as possible. Retail investors dilute the purity of a product that is ostensibly intended to be enjoyed as entertainment. A community full of people who want to exit at a profitable mark is not the same as a community full of people who want to know when the next content update is because they want to personally experience more of your product. One is here to play. The other is just here to make money. To this end, the ability of retail investors to inflate the perceived value of gaming NFTs must be directly attacked.

The most clear way to achieve this is to constantly reward gameplay, and not offer high-ticket assets outside of gameplay. Retail investors can find easy access to high-value assets in a thousand other places – but if we’re serious about breaking into gaming itself, nobody but the players achieving skill, progression, and participation should have that kind of power.

If all of this must be done, then one would certainly be inclined to ask how there are exceptions to the death of Play-2-Earn — and the answer is that those exceptions are already headed in this direction. Splinterlands and Gods Unchained were built on great gameplay, for the purpose of having a great time. Do they both have to keep selling new assets to stay afloat? Yes, of course! But that’s no different than any other game studio having to regularly release new DLC, battle passes, or other microtransactions. The revenue must flow, after all.

Play-2-Earn is dead, and much of Web3 has yet to recognize it. There is money in it today, there will be money in it tomorrow, and the decay of P2E will be a gradual process — but just as wise men advise to perceive the bear market as a “build market,” I must point out that the meat is in the process of rotting. The absence of flies must not be taken as a sign of health.

We can build better products and services than this, and that’s where the future champions of Web3 are now staking their claim.

Inner Article Image Credit: Provided by the Author; Thank you!

Featured Image Credit: Cottonbro; Pexels; Thank you!

Ryles

Ryles co-founded Overscale, a web3 publishing house for video games including first-party titles Dicesweeper, Draco Dice: Skirmish, and Rift Monsters. He also serves as the creative director for Blockchain Heroes, launched reality’s first podcast hosted as an NFT, authored several game design publications for Pearson IT, and is in the midst of writing a fiction novel.

You may like

-

We can now use cells from dead people to create new life. But who gets to decide?

-

The bird is fine, the bird is fine, the bird is fine, it’s dead.

-

Technology that lets us speak to our dead relatives has arrived. Are we ready?

-

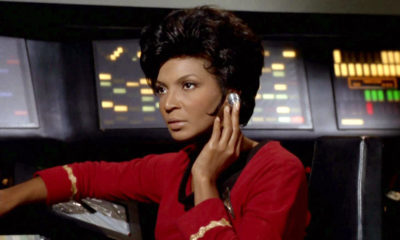

Trailblazing ‘Star Trek’ actress Nichelle Nichols is dead at 89. She broke barriers in film and helped NASA recruit women and minorities

-

Kmart might be all but dead in the real world, but it’s thriving in VR

-

Another Russian business executive with ties to Gazprom has been found dead

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.