Politics

The Power of In-App Marketing Campaigns: Re-Engage Your Customers and Drive Growth

Published

10 months agoon

By

Drew Simpson

Regardless of how well your business runs, it is nearly impossible to be 100 percent successful in all given instances. Even if your efforts are as diligent as possible, you will lose customers over time – it would be fair to say that customers lapsing with time is inevitable. Sometimes, customers may not receive their expected experience. Other times, they may lose interest in your business.

Often, losing customers is like losing touch with a college friend. While these phases are normal, it is also common for people to reconnect with their old friends or for businesses to reconnect with their old customers, for that matter. The reconnection is what a so-called win-back in marketing is.

As the Head of Customer Success at LoyaltyPlant, I have had the privilege of helping numerous established and emerging brands launch white-label mobile applications that come equipped with cutting-edge loyalty programs and a marketing engine to build effective and meaningful communication between businesses and their customers. By leveraging the power of in-app marketing campaigns, these brands have been able to take their customer engagement to new heights and drive significant growths.

What are in-app marketing campaigns?

In-app marketing campaigns are essentially push notifications that offer appealing deals once the app is opened. The key to a successful in-app marketing campaign is to target the right audience at the right time with relevant offers (that pop-up as push messages on mobile devices) in alignment with their interests. Rather than sending out mass push notifications to everyone, it is important to segment customers by considering factors such as customer demographics, purchase history to ensure that your offers stand out and are tailored to the customer’s preferences.

In-app marketing campaigns offer businesses a variety of strategies to achieve their goals, as there are countless scenarios and strategies that can be executed. One important goal is to re-engage with long-time no-see customers, and in-app win-back campaigns are particularly effective for this purpose.

Why re-engage and retain customers?

Consider the customer lifecycle of your business, including the points of contact before, during, and after purchase or visit. It’s especially important to focus on the after-purchase stage: do you make an effort to communicate with your customers and re-engage them to maintain their interest? Neglecting this stage can result in lost customers, even those who were once loyal. There are many reasons why customers may stop visiting, including natural occurrences. If you don’t communicate with your customers, you have little chance of re-engaging them after they’ve stopped visiting and retaining them in the future.

Retaining customers is essential to keeping them invested in your brand or business for the long term. This is achieved by building strong and long-lasting relationships through exceptional experiences and valuable interactions. Additionally, acquiring new customers can cost five times more than retaining existing ones.

There are several reasons why customer retention is important:

- Marketing a sale to existing customers has a higher probability of up to 60-70%

- Customer retention increases customer loyalty, leading to more word-of-mouth recommendations

- Long-term customers can provide valuable insights, including feedback and data for future brand strategies

- Retaining existing customers is significantly more affordable than acquiring new ones

- High customer retention rates lead to greater profits and lifetime customer value (LCV)

Unfortunately, many businesses focus on attracting new customers at the expense of customer retention. A solid customer service strategy is essential for retaining existing customers and maintaining long-term success.

So how do you actually win-back customers?

While win-back campaigns have been used for some time, they have largely been executed via email marketing. However, with the growing prevalence of mobile and digital technology, in-app marketing campaigns are becoming a more effective way to engage and re-engage with customers. By using push notifications that appear on a customer’s mobile device, in-app marketing campaigns offer a powerful tool for businesses looking to recapture the attention of former customers.

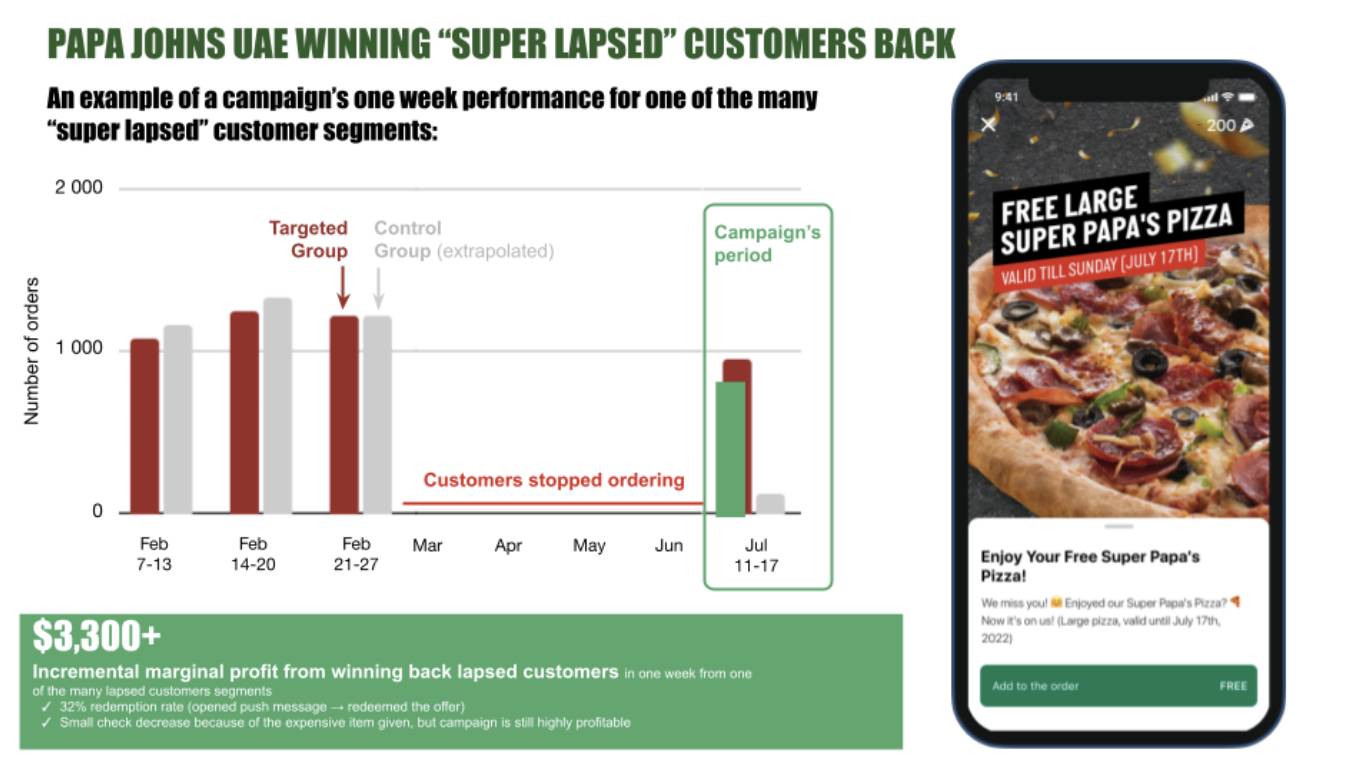

Utilizing LoyaltyPlant’s cutting-edge technology, Papa Johns UAE implemented an award-winning customer engagement strategy. Their primary goal was to win back “super-lapsed” customers who had not ordered in a long time (4-12 months). The customers were segmented based on their purchase history, and relevant complimentary items were sent along with a “We miss you!” message.

The campaign resulted in an incremental marginal profit of $3,300+ in just one week from one of the many lapsed customer segments. The redemption rate was 32% (customers who opened the push message and redeemed the offer).

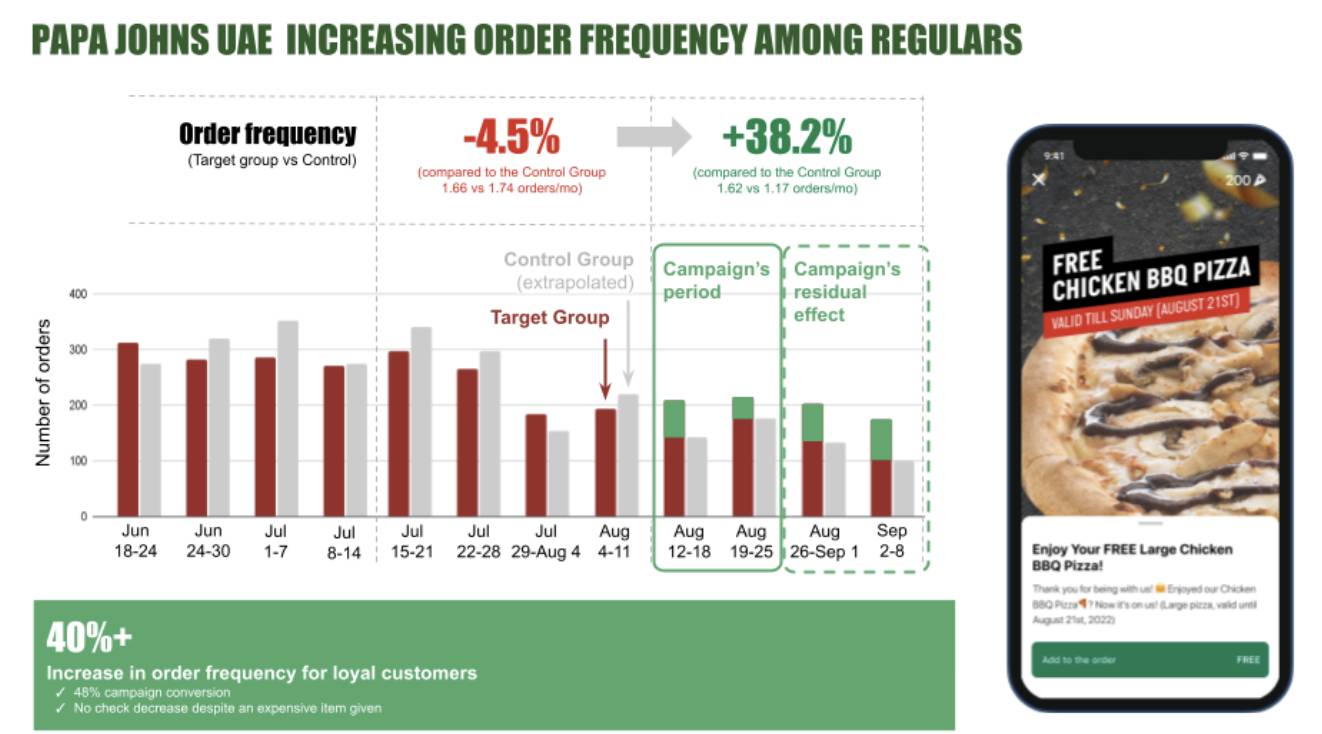

Additionally, we analyzed the churn among loyal customers and compensated for it by launching campaigns with complimentary menu items based on individual purchase history. As a result, loyal customers did not decrease their check despite the free item and even increased their order frequency by more than 40%. Moreover, the residual effect of the campaign was observed as customers continued to place orders even after the campaign was launched, indicating its long-lasting impact.

Why In-App Mobile Marketing ?

Our inboxes are often overwhelmed with various promotions and undesired spam messages. Even if the promotional email we receive is interesting, there’s a slim chance we’ll read the entire email immediately, especially when we’re, say, waiting in line for a morning cappuccino. However, with in-app push messages, businesses have a better chance of reaching their audience and capturing their attention by communicating a brief but valuable message.

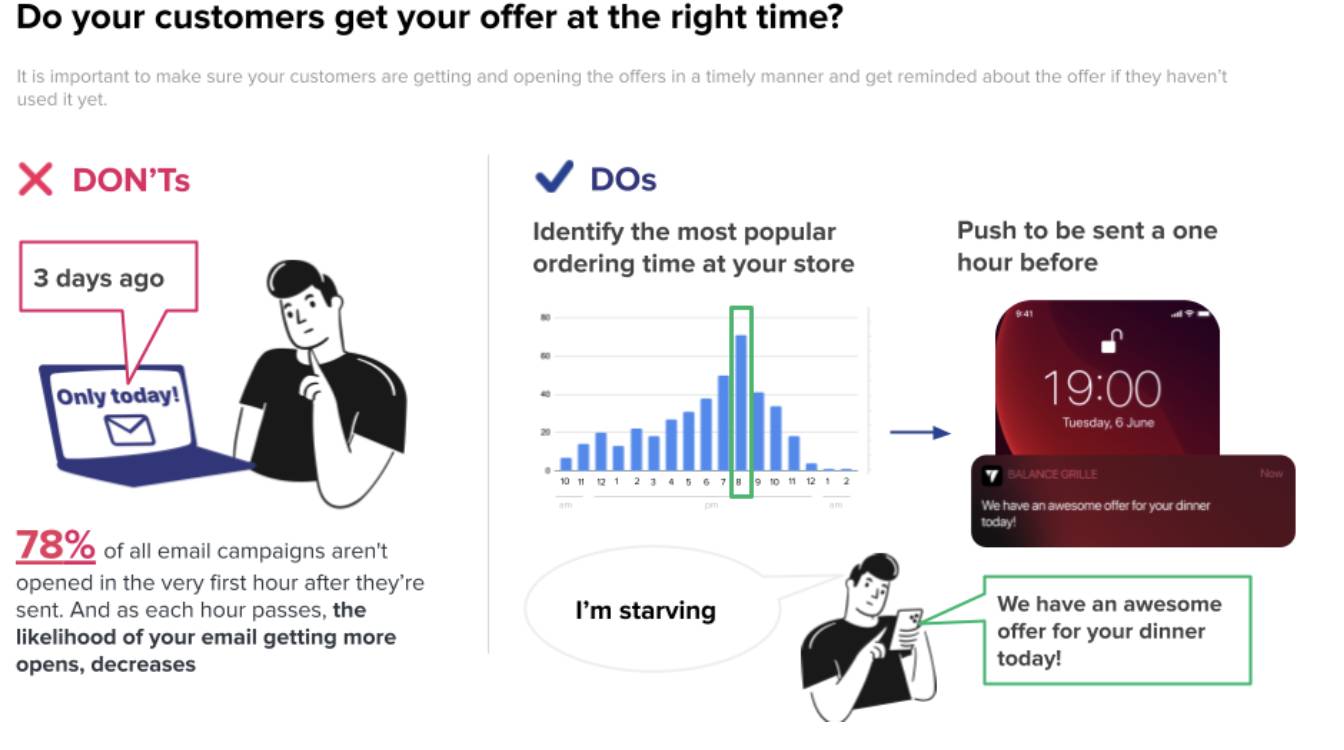

Did you know that 78% of all email campaigns are not opened within the first hour of being sent? Furthermore, the likelihood of your email receiving more opens decreases as time goes by.

LoyaltyPlant platform enables you to analyze the peak hours of order volume and predict the ideal time to send push messages to achieve the highest open rate and conversion

How to Launch Effective In-App Win-Back Campaigns?

Whether your business has a mobile communication channel in place with a push or marketing engine or you’re in search of a suitable solution, learning the most effective ways to leverage technology can make a significant impact. Keep reading to learn more about optimizing your existing technologies or finding the right solution for your business.

Segmentation

Segmenting users is a powerful way for businesses to enhance their brand’s overall customer experience and increase user engagement. Suppose you’ve launched a new feature on your brand’s mobile application. In that case, it’s likely that your highly engaged users are already aware of it, and they don’t need an in-app message about it. Sending a message to such users may even end up annoying them, which isn’t beneficial for your business. To avoid such issues, you should create segments based on customer cohorts, such as purchase history and RFM (Recency, Frequency, Monetary Value) parameters.

The RFM model is a marketing analysis method that divides a customer base into various groups based on buying tendencies. It evaluates the following parameters:

- Recency: How recently they made a purchase

- Frequency: How often they make purchases

- Monetary Value: The amount they spend on their purchases

By tracking and analyzing spending patterns, RFM helps businesses identify their best customers, retain high-scoring clients, and improve low-scoring ones. Moreover, segmentation enables marketers to target specific user groups with personalized offers that may not apply to the rest of the audience.

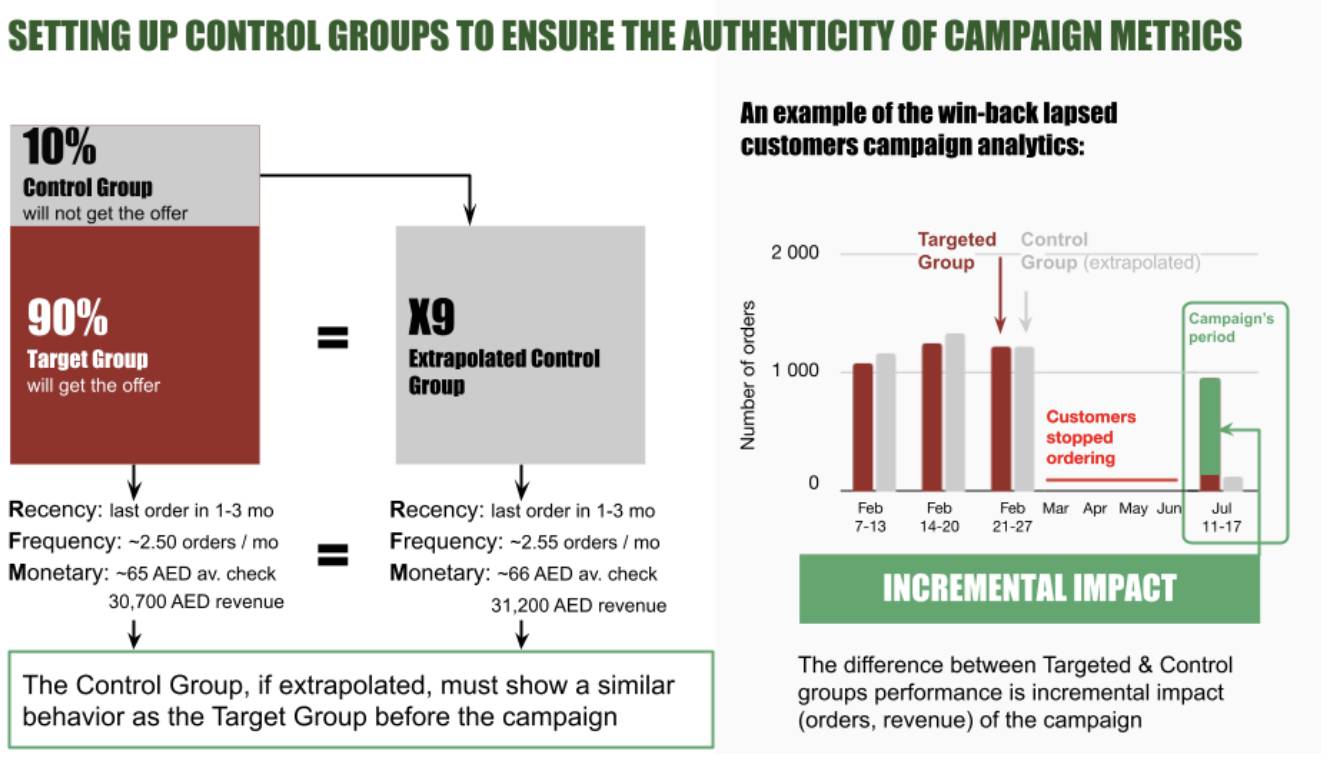

Setup Control Groups to ensure the authenticity of campaign metrics

At LoyaltyPlant, we believe in being data-driven and ensuring the authenticity of campaign metrics and results. To achieve this, we have implemented control groups to determine whether a campaign has the desired effect.

In marketing, control and target groups are essential tools to measure the effectiveness of a marketing campaign. The control group is a sample of people who do not receive the marketing message, while the target group is the sample of people who receive the message. By comparing the response rates of both groups, marketers can assess the impact of the marketing message. The control group allows marketers to isolate the impact of external factors on the response rates, such as seasonality or economic conditions. Target groups help marketers optimize their campaigns by testing different messages or creative approaches. Ultimately, control and target groups enable marketers to make data-driven decisions and improve the performance of their marketing efforts.

Target the Right Audience with the Right Message

To capture and retain user attention in in-app communications, crafting a clear and engaging message is crucial. A catchy headline can effectively direct users to take desired actions, such as making a purchase.

To make sure your in-app messages are effective, use simple language and easy-to-understand words. Avoid using technical jargon that your users may not be familiar with. Keep your message short and to the point, as in-app push notifications have limited space. Aim for a message that can be conveyed in just a few words, ideally no more than two to four. Longer sentences will be cut off and may not fit on the screen of a mobile device, making them difficult to read.

Conclusion

Brand in-app messaging is a crucial component of any successful multi-channel marketing strategy. It serves as a powerful tool for win-back campaigns that seek to reconnect and re-engage with inactive users, ultimately resulting in improved customer retention rates.

In-app messaging allows brands to communicate with their customers in a personalized and targeted manner. By sending targeted messages directly to users who have previously engaged with the brand, marketers can increase the chances of re-engaging these users and encouraging them to return to the app.

Moreover, in-app messaging also allows brands to provide users with relevant and timely information, such as product updates, special promotions, and personalized recommendations. This helps to build a stronger relationship with customers and increases the likelihood of their continued engagement with the brand.

Additionally, in-app messaging can be used to collect valuable feedback from users, helping brands to improve their products and services and better meet their customers’ needs. This feedback can be used to make necessary changes and improvements, ultimately resulting in a better user experience.

In conclusion, in-app messaging is an essential tool for brands looking to increase customer retention and engagement. By providing personalized and targeted messages, brands can re-engage with inactive users and build stronger relationships with their customers, ultimately resulting in increased customer loyalty and revenue.

Evgenia Mkrtychian

Evgenia is an award-winning Customer Success Executive & Marketing Professional with a career that spans ten years. Her field of experience ranges from technology, digital marketing, loyalty programs, client relations, and team management.

She has extensive experience creating, deploying, and optimizing initiatives that enhance the organization’s marketing strategies and customer experiences with technology.

Evgeniia writes professional publications about best practices in customer success and digital marketing.

She’s also a fan of travel, foreign languages, and good movies.

You may like

-

Four ways AI is making the power grid faster and more resilient

-

The power of green computing

-

Enabling enterprise growth with data intelligence

-

China rolls out plan to boost computing power infrastructure

-

Netflix faces stiff competition despite growth in India

-

The power and paradox of X’s Community Notes

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.