Politics

5 Vital Ways Startups Can Pull Down Employee Training Costs

Published

2 years agoon

By

Drew Simpson

Creating a highly competent and skilled workforce is a common ambition that all organizations share. In the ongoing era of enormous competition, organizations show a sense of urgency in bridging the skills gaps within their workforce. This is where employee training comes into the picture.

All organizations offer some form of training modules and programs to their employees. Besides, it is also true that employee training accounts for a significant part of the operational expenses of organizations. To elucidate, as per Indeed, the average cost of training per employee is around USD 1200.

Even if your business is based on one of the low investment business ideas, you still need to ensure that you keep the operational costs down. Sometimes, the operations costs can be far more overwhelming than the cost of starting a business. Therefore, leveraging any possible reduction in employee training costs should be on your priority list.

Suppose you wish that eagerly, you can make things work in your favor. In this article, we shed light on how small businesses can cut down on employee training costs. In addition, the report offers important and rational ways to keep training costs in check. So, let us get started without further delay.

Five ways small businesses can reduce training costs

1. Delegate responsibilities

Are you comfortable delegating authority and responsibilities as a leader, or do you like to keep the entire control to yourself? If you are not embracing the charm of delegating, you may miss the trick as a leader. The fact is that you cannot do everything on your own with identical efficiency. Besides, why would you want to do everything independently when you have a team of talented individuals?

When you delegate tasks and authority to your team members, you offer them an excellent opportunity to gain first-hand knowledge. Furthermore, I bet people learn in a more holistic way when they learn from real situations rather than classroom training. Let us take an example to substantiate this argument.

Let’s say you need to train your team for PHP development. Do you think classroom training on PHP can be more effective than actual PHP tasks? When employees are given practical exposure, they learn more wholesomely. The best part is that many classroom modules can be replaced with on-job training that you offer through delegation.

You can indeed cut down the exorbitant costs of employee training. Besides, not only can delegation help you bring down the prices, but it also helps you foster high engagement. To explain, when you delegate responsibilities, you show greater trust in your employees. Therefore, your delegation acts will be heartwarming for your employees as they will promote greater trust and acceptance.

Because of this trust, they will feel greater zeal and motivation to make a positive difference. To validate, as per Harvard Business Review, employees in companies that thrive on high trust manifest 76 percent higher engagement. Moreover, in such companies, employee productivity is 50 percent higher.

As a small business owner, you can gain big from little acts of delegation. The greater your effectiveness in delegating, the better the results. Charging can be an excellent cost-cutting strategy for your operational costs.

2. Introduce mentoring programs

Mentoring programs are a big hit in the contemporary corporate world. From small businesses to the leading global corporations, all businesses are investing in mentoring programs. Push Far shows more than 70 percent of Fortune 500 companies have mentoring programs. Additionally, 93% of SMBs see great scope in mentoring programs for upscaling their business success.

While mentoring programs have multidimensional business benefits for small businesses, a considerable reduction in employee training costs is outstanding merit. To explain, mentoring arrangements in the workplace promote a more organic approach to employee training and development. Employees learn from the first-hand experience and expertise of mentors who have spent years in their field.

Hence, not many classroom learning modules will be needed in a more natural, organized, and continuous learning environment facilitated by mentoring. You can replace a few learning modules on a few hard skills and soft skills with thoughtful mentoring programs.

Moreover, employees will be more comfortable seeking assistance and guidance in mentor-mentee relationships. If they are only going to look at you as a boss, they may not have the same confidence while seeking practical advice from you. Therefore, it makes complete sense for small businesses to introduce meticulous mentorship programs.

From effective knowledge sharing to cultivating a greater sense of belonging in the workplace, you can build various competitive advantages for your business through mentoring programs. The key is to identify the skill gaps and knowledge gaps in your workforce and create particular mentoring programs to fill these gaps.

You will not need to develop separate training programs that add to operating costs. Instead, you can spend this money on leveraging business growth with R&D spending increasingly aggressively over time.

3. Invest in Learning Management System

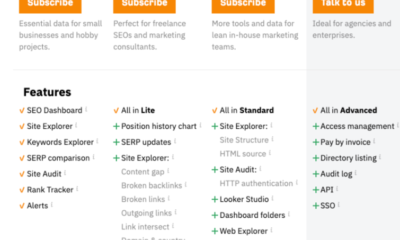

When it comes to disruptions in education and learning, LMS is among the most progressive advancements. As a result, the global learning management system market is soaring as more businesses subscribe to LMS integration. To explain, as per Fortune Business Insights, the global LMS market is projected to reach USD 40.9 billion by 2029.

LMS solutions for employee training can enhance training outcomes in an incredible way. Besides, LMS solutions are among the most cost-effective employee training and development approaches. As per Finances Online, 41 percent of business organizations have successfully brought down employee training costs with the integration of LMS.

Besides, LMS solutions also offer the scope for gamification in employee training, consistent tracking of learning outcomes, and creating personalized courses. LMS can make employee training far more effective, accessible, and comprehensive. This is one investment in the best interest of your objectives of bringing down operational expenses. The sooner you integrate LMS solutions for employee training, the more beneficial it will be for your startup.

4. Encourage leadership opportunities

The fact is that you cannot groom leaders via classroom training programs. Leaders are born out of real situations and rise to the occasion to display great leadership traits. Therefore, all organizations need to identify great prospects for leadership roles and groom them for the future.

This explains why most organizations have leadership development programs that can indeed cost a lot. However, I am trying to say here that you can groom your future leaders more practically by promoting leadership opportunities in the workplace. Expose your leadership prospects to real situations where they have actual leadership responsibilities to take care of.

A leadership opportunity can be as simple as leading one of the employee engagement activities in the workplace. The idea is to groom leadership abilities in individuals by expecting them to deliver in actual leadership roles. More importantly, in this way, you will not need to invest in excessive leadership development programs. With these additional cost savings, you can cater to other aspects of operational obligations.

Besides, your sincerest employees will view leadership roles as a great career advancement opportunity. This will further cultivate a greater sense of satisfaction among employees. As a result, you can reap more significant benefits in higher engagement and retention.

5. Shift training modules to the virtual mode

It is a well-known fact that physical training programs come with high costs of logistics and hospitality. If you are conducting training sessions over days, you have no choice but to bear these costs. However, you can save all these expenses thanks to technology by completing online training.

Interestingly, around 90 percent of employees want to access training material anytime and anywhere. Lorman further states that 85 percent of workers wish for autonomy and flexibility in learning at a time of their own choice. Moreover, 90 percent of business leaders and employers see great scope in switching to mobile-based employee training.

Therefore, as it is evident, switching to virtual training sessions is a win-win situation for all. From your employees’ perspective, they can access virtual training sessions at all times and can even learn on the go. Besides, if you look at it from the operational aspect, virtual training can be a great way to evade logistics, stationery, and hospitality costs.

Probing further, Upskilled also reveals that e-learning modules can help in enhancing learning retention by 60 percent. Besides, online learning and training also allow employees to access learning resources as often as they want. Otherwise, they cannot have round-the-clock access to lectures in physical coaching sessions.

So, the bottom line is that not only will online training help in cost savings but will also enhance learning outcomes in the organization. With online training modules, employees can learn consistently and incrementally.

Conclusion

To encapsulate, employee training is a salient operational aspect for all business organizations. To create a competent workforce, each business must invest in employee training programs and bear the same costs. It is also true that these costs can be pretty overwhelming for small businesses. However, even though employee training cannot be overlooked, a considerable part of training costs can be saved using the above approaches.

Featured Image Credit: Provided by the Author; Thank you!

Kiara Miller

“Doing what you love is the cornerstone of having abundance in your life.” Wayne Dyer’s thoughts are well suited to Kiara Miller.

Miller has been working as a content marketing professional at “The Speakingnerd.” Her passion for writing is also visible in the innovative joys of material she provides to her readers.

You may like

-

Four ways AI is making the power grid faster and more resilient

-

Plastic is a climate change problem. There are ways to fix it.

-

The Download: striking actors training AI, and breaking ‘unbreakable’ encryption

-

Why Enterprises Must Transition Beyond Traditional ETL: A Vital Imperative

-

15 Proven Ways to Increase Customer Engagement and Build Loyalty

-

Four Clever Ways to Use Tiered Pricing for Maximum Profit

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.