Politics

Is the Public Ready to Accept Deaths From Self-Driving Car Accidents? – ReadWrite

Published

3 years agoon

By

Drew Simpson

Self-driving cars are set to dramatically reduce accident rates as well as injuries and deaths from those accidents. But as they roll out and become more commonplace, they’re probably going to get some people killed. In fact, there are already early reports of fatalities caused by self-driving cars; tests of Uber’s fully autonomous vehicles have resulted in both injuries and deaths, and semi-autonomous Tesla vehicles have been involved in a number of accidents.

Is the public ready to accept deaths from self-driving car accidents? And if not, what steps would it take to get us there?

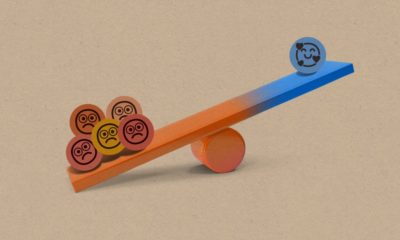

The Safety Dilemma

First, we need to understand the safety dilemma that self-driving cars introduce. Currently, there are around 35,000 deaths as a result of motor vehicle crashes in the United States each year. That’s close to 3,000 people every month, or 100 people per day. Hypothetically, if there was a new technology that could reduce that fatality rate by just 1 percent – just 1 person a day – that could save 350 lives annually. Since the majority of car accidents are attributable to human error, and autonomous vehicles can reduce the error rate to close to zero, we can assume that autonomous vehicles can sharply reduce the overall fatality rate of motor vehicle accidents (and reduce total motor vehicle accidents as well).

However, even a single car accident can cause major damage and multiple deaths, and a single incident of major negative publicity casts doubt on the safety and efficacy of self-driving cars in general. If a handful of magnified cases lead the public to believe that self-driving cars are dangerous, we could face delays of autonomous cars for years to come – ultimately resulting in more lives lost.

The Sources of Public Pushback

There are several reasons why the general public reacts negatively to the prospect of deaths from autonomous cars:

- Fear of change. People generally don’t like change. Because of status quo bias, we tend to prefer things exactly how they are, rather than risk changing dynamics in a way that could potentially make things worse. Our current motor vehicle fatality rate may be exceptionally high, but it’s what we’re used to. Incorporating autonomous vehicles on the road would require a massive overhaul to many societal constructs, forcing us to change how we think about driving, how we pay for insurance, and more. If you’re already afraid of an evolving society, and if you’re reluctant to adopt new technologies, every reported death from an autonomous vehicle is going to seem bigger and more impactful than an equivalent death attributable to human error.

- Fear of the unknown. People also fear the unknown. Right now, autonomous vehicles occupy a kind of abstract space in our minds; they’re a construct of imagination, rather than something tangible and practical. Semi-autonomous vehicles are already on the road, but most of us haven’t yet ridden in a fully autonomous vehicle, so we don’t know what it’s like. If we have no existing framework for how to consider or work with a new technology, it’s going to seem especially scary – and even more so when it does, inevitably, result in the loss of human life.

- Disproportionate reporting. Deaths and injuries from fully autonomous vehicles are often highly visible to the public, being reported on by every major news outlet in the country, while deaths from “normal” accidents are so commonplace and so readily accepted that they’re rarely acknowledged. How often do you hear about traffic fatalities in national news outlets? By contrast, any time even a semi-autonomous vehicle is involved in a collision, the news is practically impossible to escape. For members of the public unfamiliar with the hard, high-level statistics, this can make it seem like autonomous vehicles are killing people left and right – while manually driven cars are completely safe.

- Agency and control. The “trolley problem” is a well-known philosophical thought experiment in which a person is given the option of redirecting a “trolley” from one track to another; on its current course, it will kill three people, but if you divert course, it will kill only one. The utilitarian perspective is that one death is preferable to three deaths, but many people struggle with the concept of exercising agency in choosing that one person’s death. This is because people feel in charge of their decisions – and they don’t want to directly cause someone to die, even if it means passively allowing multiple other people to die in the process. On the road, drivers often feel in total control of their vehicle, capable of making their own ethical decisions and directing their own destiny. But putting them in a vehicle driving itself fills them with dread because it means their agency is being sacrificed entirely. Can you make a compelling argument to this type of person that an algorithm can make better decisions than they can? To do so would require both total faith in the algorithm developers and a willingness to abandon personal control.

- Responsibility and justice. Legitimately, some people are worried about how responsibility and justice will be served in fatal collisions involving autonomous vehicles. If someone is killed and an autonomous car is found to be the root cause of the accident, who goes to jail? Who pays the fine? Will this responsibility fall on the driver, even though they didn’t do anything to cause this accident? What about the software developer? The vehicle manufacturer? This is murky territory no matter what, but it’s especially difficult to digest if you already have apprehensions about the safety of autonomous vehicles.

- Other reasons to hate self-driving cars. Self-driving cars are going to lead us to some complicated infrastructural changes and present new dilemmas (including some we haven’t even considered yet. For many people, these changes range from scary to detestable. For example, some people hate the idea that they may someday be outlawed from owning and/or driving a manual vehicle. Some people don’t trust the autonomous vehicle industry and feel there are ulterior motives guiding the industry in this direction. Some people hate the idea of police officers being able to remotely control your vehicle if you’re caught committing a crime – or hate the idea of hackers accessing a vehicle and using it for their own gain. If you hate self-driving cars for these or other reasons, it’s easy to latch onto a fatality as a justification for your beliefs.

- Lack of firm thresholds. It’s also worth noting that most people don’t have firm thresholds they use to evaluate the efficacy of autonomous vehicles. It’s somewhat ridiculous to demand perfection; vehicles are fast and heavy machines in a complex world, so fatalities are inevitable no matter how safe the system is. But how safe is “safe enough?” Would a 1 percent drop in human lives lost be enough to satisfy your goals? What about a 5 percent drop? Are there other metrics that need to be achieved before you consider autonomous vehicles safe?

Changing the Narrative

Right now, it seems the general public is unready to accept the deaths that will inevitably be caused by autonomous vehicles – even as autonomous vehicle manufacturers set out to reduce deaths and reduce damage as much as possible. Because of this public sentiment and ongoing pushback, policymakers and manufacturers have an uphill battle ahead of them.

If we’re going to facilitate a world in which vehicular fatalities occur at a much lower rate (while simultaneously making the world more conveniently accessible to the entire population), we need to find a way to change the narrative. We need to proactively identify the root causes of anti-autonomous vehicle perspectives and work to change them from the ground up – or at least attempt to quantify and objectively evaluate those perspectives.

Frank Landman

Frank is a freelance journalist who has worked in various editorial capacities for over 10 years. He covers trends in technology as they relate to business.

You may like

-

Get ready to fight misinformation in 2024. Eric Schmidt has advice.

-

Chinese apps are letting public juries settle customer disputes

-

Are we ready to trust AI with our bodies?

-

mRNA vaccines just won a Nobel Prize. Now they’re ready for the next act.

-

This driverless car company is using chatbots to make its vehicles smarter

-

The Download: China’s AI chatbots go public, and how climate change is affecting hurricanes

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.