Politics

Unveiling the Significance of the Customer Journey

Published

10 months agoon

By

Drew Simpson

When it comes to digital marketing, grasping the concept of the customer journey takes on a major significance. At its core, a customer journey is an intricate path that an individual embarks upon when interacting with a brand over time.

With this in mind, having visibility into each distinct step of this process is incredibly important since it can make all the difference in recognizing – and potentially changing – how customers experience and engage with your products or services.

In this blog, we discuss the relevance of unlocking and optimizing the customer journey across industries to promote better overall performance from businesses, recommending beneficial practices not only for analyzing but also implementing successfully tailored journeys that stimulate long-term relationships as well as increased sales and profits.

Customer Journey

The customer journey refers to the actions and experiences that someone goes through when interacting with a product, service, or brand.

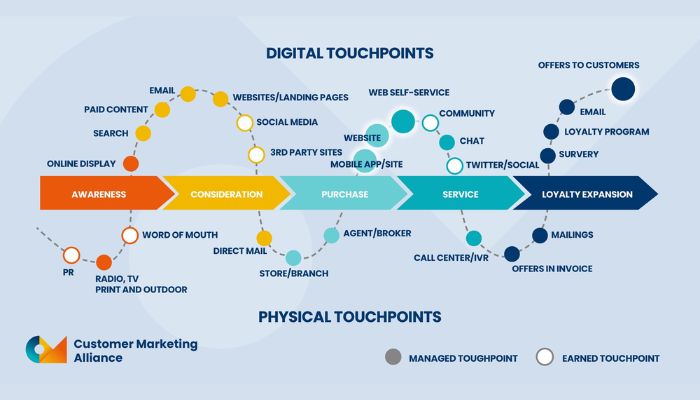

It starts at the awareness stage when customers first become aware of an organization’s offering; progresses through the consideration, decision, purchase, and post-purchase stages; and concludes where large organizational goals are accomplished.

Additionally, factors such as motivations for purchase, emotions during interactions with a brand and eventually what comes after purchase defines the customer journey overall. These steps can help organizations identify both current and potential opportunities for growing their business relationships with customers by offering personalization on more tailored levels.

Key components of the customer journey

1. Awareness stage

The Awareness stage of the customer journey is when customers first become aware of a product or brand. This could mean discovering a website online, hearing an advertisement on the radio, or attending an event with promotional giveaways related to the brand.

For marketing campaigns to be successful at this stage, they should forge strong connections between products and customers through relevant messaging and creative outlets that address particular challenges, wants, or needs in ways that stand out from competitors.

2. Consideration stage

The customer journey includes the Awareness stage, Consideration stage, Purchase stage, Service stage, and Loyalty expansion. During the Consideration stage analysis of product offerings occurs in which each alternative is compared.

At this point in time, customers are looking to acquire information about available products or services; for instance – options for purchasing a new television; scope and shipping fees from different retailers’ websites.

In order to determine customer awareness customer feedback can be analyzed or showcased testimonies may encourage conversion from prospects into paying customers.

3. Purchase stage

The Purchase stage is the third phase of the customer journey. It is when customers are likely to make either spontaneous or calculated decisions regarding their purchase.

At this stage, customers are discovering service solution offerings and researching product selections so that they can make informed decisions. Designing clear and concise calls-to-action helps facilitate conversions during this decisive component of the customer journey.

Additionally, addressing consumer pain points ahead of making a purchase offers reassurances to potential buyers that will help seal their decision in favor of your product or services.

4. Service stage

In the customer journey framework, the Service stage marks a key moment of truth for any business. It can often be the difference between customers remaining loyal and turning away. This stage covers how customers rate their brand experience from pre- to post-purchase, understanding changes that need to be deployed in order to meet expectations.

Successful brands take a service mindset when addressing customer questions and needs with personalized attention, ensure easy returns, optimize payment switches enough for hassle-free purchase journeys across platforms and ultimately create delightful out of box experiences.

5. Loyalty expansion

When assessing the customer journey, loyalty expansion should be part of the analysis. Loyalty expansion includes strategies for building trusting and profitable long-term relationships with customers through mutually beneficial experiences designed to enhance the customers’ product utilization as well as promote further consumption.

Techniques summarized under loyalty expansion include increased communications with certain customers (targeted marketing campaigns), innovative ways to optimize loyal user engagement, and advocacy growth.

Additionally, organizations must identify opportunities for delivering on customer complaints or inquiries in a timely manner while considering user feedback surveys, gamification tactics, agent training tools, and specialized pricing and package offerings in order to consistently build their brand’s reputation.

All customer journeys need focused attention from point one to ensure continued growth associated with zero attrition rates each year going forward.

Why the Customer Journey Matters

Enhancing customer experience

The customer journey consists of various stages that occur before and after a purchase. Understanding the experience from the customer’s perspective is critical to achieving business growth, as it helps optimize product offerings in order to create an enhanced customer experience.

Companies have to recognize potential pain points and address them in their products or services, personalize interactions based on customer behaviors or segmentation, and focus on building long-term relationships with customers which will ensure loyalty and retention.

Enhancing customer experiences benefit businesses as it helps capture more revenue from repeat purchases; something repeatedly expressed by practitioners as a major leap toward success in implementing a truly successful value-based marketing strategy.

Increasing customer loyalty and retention

Understanding the customer journey is essential for businesses that want to increase customer loyalty and retention. Customer journey Insights enable organizations to identify weaknesses in the buying process, address pain points, and personalize each customer’s experience.

This helps create a more satisfying experience that encourages customers to come back again and again, creating solid customer relationships that result in high repeat purchase rates.

Building up customer loyalty also increases revenue because customers are more likely to explore additional offers when their trust has been gained through experiences tailored completely around them.

By optimizing the customer journey organizations can build customer relationships focused on mutual growth that earn both aspects longer-term success.

Boosting sales and revenue

Boosting sales and revenue is an essential goal of customer journey optimization. By mapping out a customer’s path and understanding exactly how they interact with the brand, businesses gain valuable insights they can use to optimize customers’ journeys for maximum conversion rates.

Furthermore, it allows them to identify upsell and cross-sell opportunities, ensure a smooth purchasing experience for their customers, qualify their needs more effectively ahead of time, and maximize customer lifetime value over time.

Lastly, analytics like website visitor tracking and artificial intelligence chatbots help provide useful evidence-based feedback that directs decisions during the optimization process.

Tools and Techniques for Analyzing the Customer Journey

Customer feedback and surveys

Customer feedback and surveys are valuable tools for interpreting the customer journey. Surveys in particular work well for quickly gathering insights about how customers feel when using a specific product or service, areas that need improvement, overlooked opportunities for gaining new customers, and any industry-specific trends that could affect their experiences.

They can also help businesses to identify advocacy activities that their customers always support or come back to repeatedly. Using these responses as inputs can prove immensely helpful for creating a seamless customer experience by focusing on the root causes of pain points instead of spending time addressing secondary issues.

Customer feedback and surveys will provide invaluable guidance in optimizing the customer journey strategy so businesses prioritize changes that make more effective use of resources and create added value for their organization.

Social media monitoring and sentiment analysis

Social media monitoring and sentiment analysis are powerful tools for understanding the customer journey. Businesses can monitor how their brand is portrayed across popular platforms such as Twitter, Facebook, Instagram, etc., to gain valuable insights into customers’ attitudes towards them.

Through sentiment analysis, businesses can detect feelings bespoke customers have about different products or services which helps identify areas of improvement and optimize further touchpoints on the journey.

This data combined with traditional methods such as market research surveys allows business owners to refine customer campaigns according to real-world responses which leads to more effective marketing.

Customer journey mapping software

Customer journey mapping software can help businesses better understand the customer journey for a given product or service.

This type of software usually includes mapping templates that allow visual representations of how customers interact with products and services in-depth at each stage, from awareness to purchase and post-purchase, to capture data points like time spent on different interactive steps and activities.

Additionally, many journey mapping tools offer users the ability to edit and customize easily as well as conduct real-time analyses such as affinity segmentation. These offerings help companies gain deeper insight into exactly what triggers customer behavior along each step so brands can optimize their approach accordingly.

Data analytics and tracking tools

Data analytics and tracking tools play an important role in analyzing customer journeys. These powerful solutions enable businesses to monitor and track different segments of data, such as user behavior patterns, usage histories, demographics, locations, search queries, and more. They also measure customers’ authenticity level alongside click activity across multiple channels or platforms.

The insights from these analyses help businesses understand user preferences better by providing details on website journey metrics including page dwell time, conversions rate per stage, and session durations trendlines among others.

With this dispersed intelligence regarding customer interactions across various feedback channels, it then becomes easier for merchants to develop targeted tactics that felicitate desirable outcomes helping users with what they are wanting in a much more streamlined manner.

User testing

User testing and usability studies refer to important customer journey tools that allow businesses to assess the effectiveness of their products, services, or journeys to identify areas needing improvement to give customers the best possible experience.

These tests involve gathering representative in-market customers with key demographics and engaging them live or remotely in different tasks for an allotted period of time while recording their actions and reactions.

This data is then used to create report findings that highlight strengths and how they can be reinforced as well as weaknesses with useful insights into what needs attention. Taking these actionable suggestions into account helps organizations fine-tune any experiences and journeys they offer so customers have more streamlined digital experiences that deliver value automatically at exponential speed.

Conclusion

The customer journey is central to the success of any business or organization. And targeting is getting harder. By understanding and analyzing every stage, organizations can optimize their customer experience and have a significant impact on customer loyalty levels, retention rates, conversions, sales revenue, and much more.

As technology continues to evolve, new tools are constantly becoming available that allow businesses to explore the depths of the customer journey for further insight into how they can improve their processes in efforts to continually grow and improve their offerings.

With all these resources available to analyze customers’ interactions throughout the life stages of an organization, it should be made a priority effort for everyone from B2B and retail companies alike. Only then will you see real results open up this opportunity for growth and expansion within your company.

Nate Nead

Nate Nead is the CEO & Managing Member of Nead, LLC, a consulting company that provides strategic advisory services across multiple disciplines including finance, marketing and software development. For over a decade Nate had provided strategic guidance on M&A, capital procurement, technology and marketing solutions for some of the most well-known online brands. He and his team advise Fortune 500 and SMB clients alike. The team is based in Seattle, Washington; El Paso, Texas and West Palm Beach, Florida.

You may like

-

Chinese apps are letting public juries settle customer disputes

-

Customer experience horizons

-

15 Proven Ways to Increase Customer Engagement and Build Loyalty

-

5 Ways to Reduce Customer Churn

-

4 Ways Brands Leverage AI and ML for Compelling Customer Interactions

-

Why Connected CX is Essential for Building a Seamless Customer Journey

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.