Politics

Gen Z’s Reaction to Negative Brand Experiences: The Confluence of Customer Service and Technology

Published

10 months agoon

By

Drew Simpson

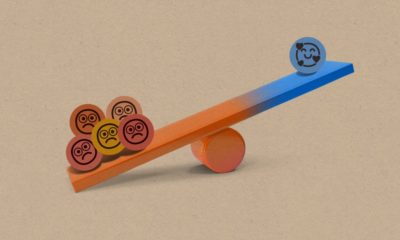

The reactions and preferences of Generation Z (Gen Z) consumers are playing an increasingly pivotal role in shaping brand strategies. With the advent of digital technology and social media, Gen Z’s response to negative brand experiences is remarkably different from previous generations, often leading to brand abandonment after just one poor experience and a pervasive online discussion about the experience.

Research carried out by TCN, Inc, highlights that almost three-quarters of consumers would forsake a brand following a single unsatisfactory customer service encounter. The research further discovered that, for the third consecutive year, the most favored method of interaction with a company’s customer service team is through a live agent. This inclination towards human connection underscores the continued significance of a personal touch in customer service, even in this digital era.

For Gen Z consumers, the intensity of these reactions is even more pronounced. 75% of Gen Z individuals (aged 18-26) have shared an online review following an unfavorable experience, significantly exceeding the average of 44%. This act of sharing experiences online underscores Gen Z’s tendency to publicly broadcast their experiences, both positive and negative, thus shaping the perceptions of prospective customers.

Gen Z, the first generation to grow up with the internet and smartphones from a young age, are digital natives. This constant connectivity has led them to become accustomed to instant gratification and quick solutions. They expect brands to be just a click away, providing immediate, efficient, high-quality service. When a company fails to meet these expectations, Gen Z consumers can quickly become frustrated, leading to a negative reaction.

Desire for Personalization

Being digital natives, Gen Z consumers have grown up with personalized online experiences. From social media feeds to online shopping recommendations, they are used to being treated as individuals with unique needs and preferences. As such, they expect the same level of personalization from customer service interactions. When customer service fails to recognize them as individuals and instead treats them as just another ticket number, it can lead to dissatisfaction and negative responses.

The Social Media Effect

For Gen Z, social media is not just a platform for connecting with friends—it’s a platform for expressing their opinions, sharing experiences, and seeking advice. When they encounter poor customer service, they are likely to share their experience on social media. This public airing can amplify the negative reaction, as it brings it to the attention of a wider audience and may elicit supportive responses from their peers. The viral nature of social media can quickly escalate a single negative customer service incident into a significant brand crisis.

Influencing Purchase Decisions

Research has shown that Gen Z consumers trust online reviews as much as personal recommendations. When they experience poor customer service, they are not just likely to switch brands; they are also likely to leave negative reviews. These reviews can impact other Gen Z consumers’ purchase decisions, leading to a ripple effect of negativity and potential loss of customers for the brand.

Value Authenticity and Transparency

Gen Z values authenticity and transparency from brands. They expect companies to own up to their mistakes, apologize sincerely, and take swift corrective action. When customer service is poor, and companies fail to respond appropriately, it can be seen as a breach of authenticity and transparency. This can trigger a strong negative response, as it goes against the values that Gen Z holds in high regard.

Impact of Poor Customer Service on Brand Loyalty

While Gen Z is known for its brand loyalty, this loyalty is hard-earned and easily lost. Gen Z consumers are willing to reward brands that provide excellent customer service with their loyalty. However, they can quickly abandon a brand if their customer service experience is poor. Given the abundance of options available to them, they have no qualms about switching to a competitor that promises a better experience.

In the quest to cater to the demanding expectations of Gen Z, brands are leveraging advanced technologies like Artificial Intelligence (AI) and Augmented Reality (AR). These technologies have gained significant ground in enhancing the customer experience.

AI’s huge array of tools can help recognize consumer buying patterns and deliver hyper-personalized shopping experiences. This is particularly relevant in today’s retail scenario, where Gen Z consumers expect a seamless, personalized experience whether they’re shopping online or in-store.

Here’s how AI can help recognize consumer buying patterns:

- Analyzing Data: AI systems can analyze crazy amounts of data, such as past purchases, browsing history, and social media interactions. This data is used to identify patterns in consumer behavior, enabling businesses to predict future purchasing decisions.

- Predictive Analytics: AI uses predictive analytics to forecast future consumer behavior based on historical data. These predictions help businesses anticipate customer needs and tailor their offerings accordingly.

- Personalization: AI can use consumer buying patterns to personalize advertising or marketing campaigns. This might involve recommending products based on past purchases or suggesting items related to a customer’s search history.

- Customer Segmentation: AI can group customers based on shared characteristics or behaviors, known as segmentation. This can help businesses understand the different buying patterns within their customer base and tailor their marketing efforts to each segment.

- Sentiment Analysis: By analyzing customer reviews, social media posts, and other online content, AI can understand how consumers feel about certain products or brands. This can reveal trends in customer satisfaction and highlight areas for improvement.

- Chatbots and Virtual Assistants: AI-powered chatbots and virtual assistants can interact with customers, answer questions, and make recommendations. They can learn from these interactions, improving their ability to recognize individual customer preferences and buying patterns.

- Real-time Data: AI can provide real-time analysis and insights into consumer behavior, allowing businesses to adapt quickly to changes in buying patterns. This could involve adjusting pricing or promotional strategies in response to shifts in demand.

AR, on the other hand, merges the digital and physical realms, providing an interactive shopping experience. By using AR, brands can guide consumers through a physical store as if it were an online platform, offering unique customer experiences that can turn an ordinary shopping trip into an engaging exploration.

The cornerstone of winning Gen Z’s loyalty lies in providing exceptional customer service, both in-person and digitally, while continuously innovating and personalizing the shopping experience. Brands that prioritize and effectively execute these aspects will be better positioned to weather the storm of a negative review and turn it into an opportunity for improvement and growth.

In conclusion, the response of Gen Z consumers to negative brand experiences underscores the urgent need for brands to recalibrate their customer service strategies. Brands need to understand that Gen Z is not a silent consumer generation; they are outspoken and will not hesitate to share their experiences online, influencing the decisions of potential customers. Furthermore, Gen Z’s affinity for brands offering personalized experiences and quality customer service signifies that businesses investing in AI and AR technologies will likely gain a competitive edge.

Featured Image Credit: Photo by Polina Tankilevitch; Pexels; Thank you!

Adam Torkildson

I’m a digital asset investor; founder of Tork Media; father, mentor, and husband. I love getting pitched about new tech startups, especially in the AI space.

You may like

-

How carbon removal technology is like a time machine

-

Chinese apps are letting public juries settle customer disputes

-

Customer experience horizons

-

How to make government technology better

-

Top Strategies of Lead Generation for Technology Companies

-

15 Proven Ways to Increase Customer Engagement and Build Loyalty

Politics

Fintech Kennek raises $12.5M seed round to digitize lending

Published

7 months agoon

10/11/2023By

Drew Simpson

London-based fintech startup Kennek has raised $12.5 million in seed funding to expand its lending operating system.

According to an Oct. 10 tech.eu report, the round was led by HV Capital and included participation from Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures, and Syndicate One. Kennek offers software-as-a-service tools to help non-bank lenders streamline their operations using open banking, open finance, and payments.

The platform aims to automate time-consuming manual tasks and consolidate fragmented data to simplify lending. Xavier De Pauw, founder of Kennek said:

“Until kennek, lenders had to devote countless hours to menial operational tasks and deal with jumbled and hard-coded data – which makes every other part of lending a headache. As former lenders ourselves, we lived and breathed these frustrations, and built kennek to make them a thing of the past.”

The company said the latest funding round was oversubscribed and closed quickly despite the challenging fundraising environment. The new capital will be used to expand Kennek’s engineering team and strengthen its market position in the UK while exploring expansion into other European markets. Barbod Namini, Partner at lead investor HV Capital, commented on the investment:

“Kennek has developed an ambitious and genuinely unique proposition which we think can be the foundation of the entire alternative lending space. […] It is a complicated market and a solution that brings together all information and stakeholders onto a single platform is highly compelling for both lenders & the ecosystem as a whole.”

The fintech lending space has grown rapidly in recent years, but many lenders still rely on legacy systems and manual processes that limit efficiency and scalability. Kennek aims to leverage open banking and data integration to provide lenders with a more streamlined, automated lending experience.

The seed funding will allow the London-based startup to continue developing its platform and expanding its team to meet demand from non-bank lenders looking to digitize operations. Kennek’s focus on the UK and Europe also comes amid rising adoption of open banking and open finance in the regions.

Featured Image Credit: Photo from Kennek.io; Thank you!

Radek Zielinski

Radek Zielinski is an experienced technology and financial journalist with a passion for cybersecurity and futurology.

Politics

Fortune 500’s race for generative AI breakthroughs

Published

7 months agoon

10/11/2023By

Drew Simpson

As excitement around generative AI grows, Fortune 500 companies, including Goldman Sachs, are carefully examining the possible applications of this technology. A recent survey of U.S. executives indicated that 60% believe generative AI will substantially impact their businesses in the long term. However, they anticipate a one to two-year timeframe before implementing their initial solutions. This optimism stems from the potential of generative AI to revolutionize various aspects of businesses, from enhancing customer experiences to optimizing internal processes. In the short term, companies will likely focus on pilot projects and experimentation, gradually integrating generative AI into their operations as they witness its positive influence on efficiency and profitability.

Goldman Sachs’ Cautious Approach to Implementing Generative AI

In a recent interview, Goldman Sachs CIO Marco Argenti revealed that the firm has not yet implemented any generative AI use cases. Instead, the company focuses on experimentation and setting high standards before adopting the technology. Argenti recognized the desire for outcomes in areas like developer and operational efficiency but emphasized ensuring precision before putting experimental AI use cases into production.

According to Argenti, striking the right balance between driving innovation and maintaining accuracy is crucial for successfully integrating generative AI within the firm. Goldman Sachs intends to continue exploring this emerging technology’s potential benefits and applications while diligently assessing risks to ensure it meets the company’s stringent quality standards.

One possible application for Goldman Sachs is in software development, where the company has observed a 20-40% productivity increase during its trials. The goal is for 1,000 developers to utilize generative AI tools by year’s end. However, Argenti emphasized that a well-defined expectation of return on investment is necessary before fully integrating generative AI into production.

To achieve this, the company plans to implement a systematic and strategic approach to adopting generative AI, ensuring that it complements and enhances the skills of its developers. Additionally, Goldman Sachs intends to evaluate the long-term impact of generative AI on their software development processes and the overall quality of the applications being developed.

Goldman Sachs’ approach to AI implementation goes beyond merely executing models. The firm has created a platform encompassing technical, legal, and compliance assessments to filter out improper content and keep track of all interactions. This comprehensive system ensures seamless integration of artificial intelligence in operations while adhering to regulatory standards and maintaining client confidentiality. Moreover, the platform continuously improves and adapts its algorithms, allowing Goldman Sachs to stay at the forefront of technology and offer its clients the most efficient and secure services.

Featured Image Credit: Photo by Google DeepMind; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.

Politics

UK seizes web3 opportunity simplifying crypto regulations

Published

7 months agoon

10/10/2023By

Drew Simpson

As Web3 companies increasingly consider leaving the United States due to regulatory ambiguity, the United Kingdom must simplify its cryptocurrency regulations to attract these businesses. The conservative think tank Policy Exchange recently released a report detailing ten suggestions for improving Web3 regulation in the country. Among the recommendations are reducing liability for token holders in decentralized autonomous organizations (DAOs) and encouraging the Financial Conduct Authority (FCA) to adopt alternative Know Your Customer (KYC) methodologies, such as digital identities and blockchain analytics tools. These suggestions aim to position the UK as a hub for Web3 innovation and attract blockchain-based businesses looking for a more conducive regulatory environment.

Streamlining Cryptocurrency Regulations for Innovation

To make it easier for emerging Web3 companies to navigate existing legal frameworks and contribute to the UK’s digital economy growth, the government must streamline cryptocurrency regulations and adopt forward-looking approaches. By making the regulatory landscape clear and straightforward, the UK can create an environment that fosters innovation, growth, and competitiveness in the global fintech industry.

The Policy Exchange report also recommends not weakening self-hosted wallets or treating proof-of-stake (PoS) services as financial services. This approach aims to protect the fundamental principles of decentralization and user autonomy while strongly emphasizing security and regulatory compliance. By doing so, the UK can nurture an environment that encourages innovation and the continued growth of blockchain technology.

Despite recent strict measures by UK authorities, such as His Majesty’s Treasury and the FCA, toward the digital assets sector, the proposed changes in the Policy Exchange report strive to make the UK a more attractive location for Web3 enterprises. By adopting these suggestions, the UK can demonstrate its commitment to fostering innovation in the rapidly evolving blockchain and cryptocurrency industries while ensuring a robust and transparent regulatory environment.

The ongoing uncertainty surrounding cryptocurrency regulations in various countries has prompted Web3 companies to explore alternative jurisdictions with more precise legal frameworks. As the United States grapples with regulatory ambiguity, the United Kingdom can position itself as a hub for Web3 innovation by simplifying and streamlining its cryptocurrency regulations.

Featured Image Credit: Photo by Jonathan Borba; Pexels; Thank you!

Deanna Ritchie

Managing Editor at ReadWrite

Deanna is the Managing Editor at ReadWrite. Previously she worked as the Editor in Chief for Startup Grind and has over 20+ years of experience in content management and content development.